Another Housing Crash?

In California the general trend here is people want to be as close to the coast and Metro centers as possible.

Of course that’s very expensive. So people start moving away to get whatever they can afford. So you have places like Palmdale and Santa Clarita where people don’t actually want to live there, but it’s all they can afford. Another Housing Crash?

During the last housing crash in 2006, these less desirable markets suffered terribly. And it seems like history is repeating itself because they are really not desirable unto themselves except for the fact that they are within driving distance to Los Angeles or San Diego or the coast.

For the 2nd consecutive month, Corelogic downgraded their housing market predictions over the next 12 months due to rising mortgage rates which is hampering housing affordability.

Every Economic Signal I’ve looked at is flashing red. 25 million homes owned by investors are subject to economic conditions which are looking bleak. I expect a lot of those to sell when it becomes obvious that they are not going to generate the revenue expected from rents.

Plus, the inventory of new housing starts that will be hitting the market in the next several months and mortgage prices increasing as the FED increases interest rates. Many new home builders are already getting cancelations. Layoffs are increasing from zombie corporations that have never made a profit and their funding is being pulled.

Home foreclosures will also create a strong drag on prices. Renters drive the investment market and they are being squeezed already. It’s only going to get tighter.

To wrap this up, I think that many areas that have seen astronomical, irrational home price appreciation over the past couple of years, are now going to see a similar but reverse price depreciation! I think in many local markets, this depreciation will easily exceed 20% or more from the market tops!

There is a perfect storm forming in America. inflation, severe drought in the farm belt, the pandemic, food shortages, diesel fuel costs, and heating fuel shortages, baby formula shortages, shortage of and price of available cars, and the price of housing. It’s all coming together and could lead to real disaster for our economy.

Always keep in mind, that purchasing or selling a home is a major lifestyle decision, and as such, should not be rushed into. So, by all means, if you’re considering purchasing or selling real estate in today’s market, do your own homework and draw your own conclusions! But, also consult with your legal & financial advisors prior to making your moves.

My opinions here are just that, opinions! The fact that I’ve been in the residential real estate market for over three decades, does not mean that my opinions are going to be any more accurate then your mother-in-law’s opinion, though I sure hope they are!

For those of you who may not be regular readers here is the link to the first warning blog post that I put out; my first post where I called the real estate market top was June 15, 2021 (https://www.brokerforyou.com/brokerforyou/real-estate-market-downturn/ ) . On June 17 2021, I had a follow-up post ( https://www.brokerforyou.com/brokerforyou/real-estate-market-bust/ ) where I added additional indicators, that to me showed that the market was in a topping phase right now! I put the links to each one of those prior post above, and would suggest if you’re interested, to reread those posts!

Buckle up your seatbelt because the downward ride has just started!

Another Housing Crash?

#######

-

Brokerforyou.com is for SALE

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google, they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion! YouTube now operates as one of Google’s subsidiaries.

www.brokerforyou.com is for sale and is offered with a very popular San Diego residential real estate channel with 1.16K subscribers and 114 videos!!

What’s the approximately monthly cost to host a website? With shared hosting, you’re hosting fee can break down to about 10 to $15 per month. To keep your url registered (that’s your site address), this is usually paid on a five to 10-year basis, which averages out to about just a dollar per month! Naturally, if you add direct hook-up to a MLS database, that provides lead capturing, this costs can vary greatly from provider-to-provider.

Interested, call Bob Schwartz (619) 286-5604 for additional information

-

#######

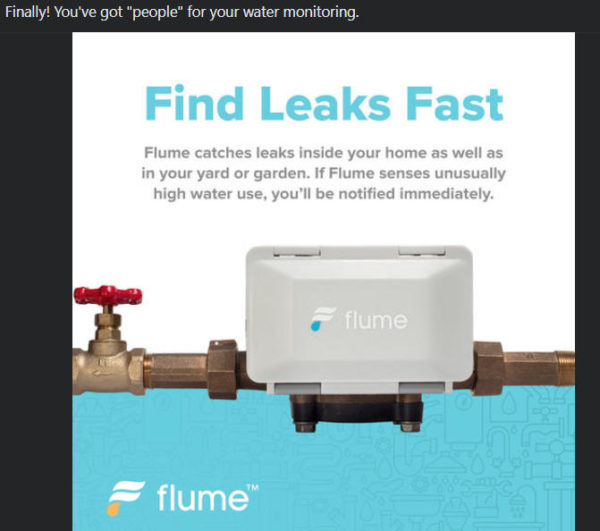

home water leak detector – https://flumewater.com?grsf=w79pta

+++++++++++++

Great DRONE Value