Real Estate Market Downturn

1st signs of the Real Estate Market Downturn (Note published June 2021)

I’ve been in residential real estate for over three decades and I can tell you that major real estate market turns do not happen on a dime! If you study the residential real estate market, there are subtle signs of major market turns. Precisely because these are at first relatively minor moves, they are usually discounted or overlooked by the press and most real estate professionals. One should keep in mind that the residential real estate market professionals are not so much professional market timers – actually they probably are no better at market timing than your average dog groomer – but are just very good salespeople! Yes, the residential real estate market professionals are professional salespeople and nothing more.

Real Estate Market Downturn

Upon entering into a residential real estate career most people are taught that they should block out all negativity and should always be optimistic on an ever-appreciating real estate market. That’s all well and good, but for most in the industry, blocking out negativity in their minds, also means blocking out reality! If you are around as I was for the residential real estate market collapse that started in 2005, it would be ingrained upon you that all residential real estate markets are subject to major downturns. Of course, if you can hold onto your property, values may return to what they were at the peak and as we’ve seen currently, exceed that peak. In the case of the 2005 downturn it took almost 10 years to recover. Because we are talking about residential real estate, many cannot hold on, and actually end up selling at a loss. Yes, life steps in, people have to move for better job opportunities, illness, unforeseen personal financial difficulties and even death.

There’s not much we can do about life’s ebb and flow except go along for the ride. However, if you have the luxury of being able to time your next home sale or home purchase you should seriously review the current local real estate market environment not only for your particular area, but your entire state, and to a lesser extent the nation. Over my career I’ve seen many people, including real estate professionals, make disastrously timed market entry and exit decisions based solely on the popular herd theory that you can never really lose in the real estate market, and it’s always a good time to buy.

Whether buying or selling residential real estate, the decision is often a major milestone in ones’ lifecycle. If you have the luxury of being able to time such moves, talking to your real estate professionals, legal and tax advisors, and doing your own in-depth comprehensive evaluation of the current market conditions could definitely improve your odds of making the right decision, at the right time, and gaining tens of thousands of dollars over the general public.

With all that said, let’s get down to the nitty-gritty of my own personal opinion on what’s happening in the residential real estate market right now. As I said in some of my other articles, in my over three decades of experience in residential real estate I’ve never seen a market so wildly exuberant as the one we’re experiencing now.

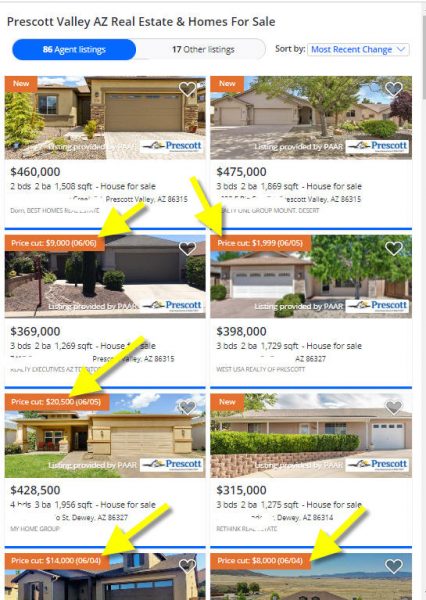

I’ve been tracking the Prescott and Prescott Valley, Arizona, residential real estate market for a couple years now. On the chart above from the Zillow website, you should note that of the first eight properties shown, five are showing asking price reductions! I first noticed this a couple of weeks ago, and then again for the last few weeks including up until today. It’s not always such a high ratio of price reductions, but there are always a number of them coming up in this most “recent change” category. Under this category all the new listings appear as well as price changes. I’ve not placed this in any type of order it’s just a random the way it first comes up on the website. As I said, I’ve never noticed multiple price reductions like this since I started researching the area. This is a very very hot retirement area with a lot of California and Midwest folks moving here with lots of cash from their out-of-state property sales. I venture to say that homes here in the mid-300,000 range 18 months to a year ago, are now selling for about $100,000 or more, over their values 18 months ago!

Keep in mind, during this period of time nothing really has changed, and if anything more Californians have been moving into Arizona. Also, many of the home sales here are all cash! It’s my opinion that this can be the first indicator to show that this market is topping out and this trend will soon be moving throughout the country and especially the areas that have seen mega-appreciation over the last 18 months to two years.

This is just my speculation and actually kind of a long shot just because it’s only one of the first indicators of real estate market trouble. Honestly, I think it very prudent before calling an actual top in our real estate market, we see this trend appearing in other states accompanied by an increase in inventory and a slow-down in property sales. If this occurs, then we would have three indicators pointing towards trouble for the residential real estate markets throughout the country!

Naturally, before making any major real estate moves always consult your financial and legal advisors and keep in mind that every market is different and it’s almost always very difficult to call the top, or bottom, in the residential real estate markets.

*******************

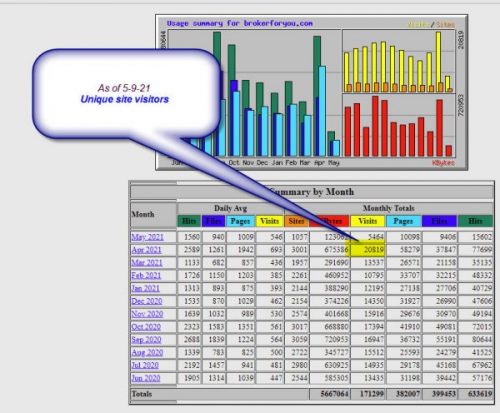

www.brokerforyou.com *** This 21 year old San Diego real estate website is for sale! Also, aged real estate sites in many California cities are for sale.

Over 20,000 unique visits in April 2021

++++++++++++++++++++++++++

Visit our Youtube San Diego real estate channel

Real Estate Market Downturn

Trackbacks & Pingbacks

- Real estate market bust! - San Diego real estate market | San Diego real estate market

- Real Estate Market Top - San Diego real estate market | San Diego real estate market

- Housing market slow down - San Diego real estate market | San Diego real estate market

- Housing Deflation? - San Diego real estate market | San Diego real estate market

Comments are closed.

Well written and totally concur, as I see the little minor shifts starting to take place here. Although, as I look at the closings for the last 10 days in the best areas, i see sale prices that are $20 to even $150k over the list price, and asking who would pay $1.250k for a small house in Univ. City that was listed at $1.050!! A dumb individual buyer or a Corp. LLC entitly? Well, in a few cases, this was correct, it was NOT just your regular end-user buyer but an LLC with large amounts of cash that they have gathered together or hard money that went up to 90-100% LTV, and created huge leverage. Just what they’re going to do with it is even more of a puzzle, certainly can’t rent it for over $4k.\

And college area is now turning into ADU mania, and anything that can be converted to ADU is being snapped up. That ship will be getting heavy very soon, as too many people have boarded and will start to sink.

Imagine your N’hood just turning into one large student party every Sept to june.

Zapp