Housing Crash has Started

Baby Boomers Forced to Liquidate their homes.

Baby Boomers are about to liquidate 30 Million Homes over the next several decades. Flooding the US Housing Market with inventory and creating the potential for a 30-Year Housing Crash.

Housing Crash has Started

It never ceases to amaze me that people cannot accept the fact that residential real estate property can actually decline in price. Sure, a lot of first-time buyers now are in their thirties which means that during our last crash which occurred around 2006 to 2008, they may have been just 15 years old. So, I’m sure they weren’t paying attention to real estate values back then.

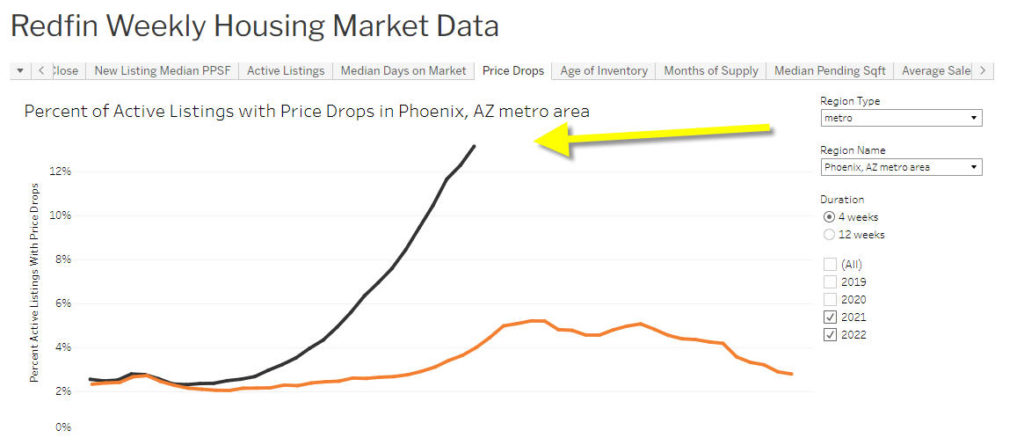

Here in the Phoenix Arizona area over the last two years on average residential real estate prices increased by over 25% a year! Yes, if there was ever a prime example of the irrational exuberance in the real estate market, the Phoenix area would have to take first place! Yet, it seems that a lot of these first-time buyers just cannot accept the fact that the residential real estate market has hit a ceiling and has now taken 180 degree turn toward the downside.

But, facts are facts oh, and there can be no doubt that this Market and the huge housing bubble that was created has now burst. Because the average escrow can run between 45 to 60 days, many areas are still reporting increasing housing prices. But, don’t be fooled by this wagging indicator. These same areas are also showing huge price drops on listed properties as well as increased inventories of homes for sale. The sales price drops will follow, and we should see those within about 60 days. Once the sales price drops are reported the downward trend and property values will have been well underway.

As I’m writing this, the Federal Reserve just increased interest rates by 3/4 of percentage point! In my opinion, this large interest rate increase by the Fed is kind of like, watching a vampire movie where are wooden stake is hammered through the heart of a vampire. But now, the Federal Reserve is wielding that wooden stake in the form of yet another huge interest rate increase.

To wrap this up, I think that many areas that have seen astronomical, irrational home price appreciation over the past couple of years, are now going to see a similar but reverse price depreciation! I think in many local markets, this depreciation will easily exceed 20% or more from the market tops!

There is a perfect storm forming in America. inflation, severe drought in the farm belt, the pandemic, food shortages, diesel fuel costs, and heating fuel shortages, baby formula shortages, shortage of and price of available cars, and the price of housing. It’s all coming together and could lead to real disaster for our economy.

Always keep in mind, that purchasing or selling a home is a major lifestyle decision, and as such, should not be rushed into. So, by all means, if you’re considering purchasing or selling real estate in today’s market, do your own homework and draw your own conclusions! But, also consult with your legal & financial advisors prior to making your moves.

My opinions here are just that, opinions! The fact that I’ve been in the residential real estate market for over three decades, does not mean that my opinions are going to be any more accurate then your mother-in-law’s opinion, though I sure hope they are!

For those of you who may not be regular readers here is the link to the first warning blog post that I put out; my first post where I called the real estate market top was June 15, 2021 (https://www.brokerforyou.com/brokerforyou/real-estate-market-downturn/ ) . On June 17 2021, I had a follow-up post ( https://www.brokerforyou.com/brokerforyou/real-estate-market-bust/ ) where I added additional indicators, that to me showed that the market was in a topping phase right now! I put the links to each one of those prior post above, and would suggest if you’re interested, to reread those posts!

Buckle up your seatbelt because the downward ride has just started!

Housing Crash has Started

#######

-

Brokerforyou.com is for SALE

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google, they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion! YouTube now operates as one of Google’s subsidiaries.

www.brokerforyou.com is for sale and is offered with a very popular San Diego residential real estate channel with 1.16K subscribers and 114 videos!!

What’s the approximately monthly cost to host a website? With shared hosting, you’re hosting fee can break down to about 10 to $15 per month. To keep your url registered (that’s your site address), this is usually paid on a five to 10-year basis, which averages out to about just a dollar per month! Naturally, if you add direct hook-up to a MLS database, that provides lead capturing, this costs can vary greatly from provider-to-provider.

Interested, call Bob Schwartz (619) 286-5604 for additional information

-

#######

home water leak detector – https://flumewater.com?grsf=w79pta

+++++++++++++

Great DRONE Value

San Diego Realtor here. I’m sorry, but respectfully I disagree.

Homeowners have been deeply scrutinized for their loans since 2008. And, generally speaking, they have not been taking out HELOC’s, thus using their home as a bank. When the housing market crashed in the mid-2000’s, many buyers received their loan approval based on a cocktail napkin review (stated income). In addition, they accepted no-interest loans and ARM mortgages that were bound to adjust up. This, by most accounts, was the cause of the 2000’s real estate crash.

That was then, this is now…

If a new homeowner purchased recently, the question is, can they afford their mortgage? Well first, virtually no one has purchased using an adjustable mortgage. So that part of the equation is out. And, if they bought in the last year, they likely survived COVID shutdowns. If they bought two or more years ago, their home values increased dramatically so while they may sell, it won’t be at a loss. Have some been hanging on by a thread due to COVID? Maybe, but I have read that there were a total of about 5,000,000 US homeowners who requested forbearance on their loan. Of those, 80% have exited their forbearance. So that in theory leaves 1,000,000 homeowners nationwide that are seemingly more vulnerable. Note that in 2005, before the collapse, there were over 500,000 Even if all 1,000,000 had to sell, that’s not a number, IMHO, that would have a nationwide affect on home values.

While home prices may decrease in the months/years ahead, most homeowners have significant equity in their home. If for some reason they can’t afford the mortgage payment they were previously well qualified for, when they sell, it won’t be as a foreclosure or short sale. I would propose that the increased listings will help balance out the supply and demand issue we continue to have.

Lastly, if you look at long term interest rates, since 1971, about two-thirds of the time interest rates have been 6% or higher. No doubt today’s buyers will need to adjust to a return to the norm but I don’t think we need to feel like the sky is falling.

Just one other Realtor’s opinion.

Follow up… I didn’t see your video regarding the affect of Baby Boomer homes possibly coming on the market. That’s a good point. I will be interested in seeing how this affects the market in the years ahead.

Richard – Certainly hope you’re right , but I think not! In my own humble opinion the only thing this downturn has in common with 2008, is that this time down, it’s going to be much worse!

Sure, some of the loan practices have been cleaned up but that’s not what’s turning this Market down, it’s the economy.

Actually, it’s the economy, and many negative factors coming together at one time. I’ve been in the residential real estate business for over three decades and I’ve never seen anything like the irrational exuberance of the past few years! I mean, do you really believe that 25 + percent or year home appreciation is normal, or even rational?

Depending on your point of view, we are sure in a slow economy that used to be called a recession. Many high paying tech jobs I’ve already started to be cut, the Federal Reserve has said there are more interest rate hikes in the future, with a possible half a percent hike coming in September.

Poorly conceived green energy policies have forced gas and diesel prices to all-time highs. Fertilizer has taken a tremendous jump up in price and we’re going to see the results of that in much higher food prices starting this fall. I could go on, but, really the market says it all, and with the hottest sales time of the year right now the market has been falling at a tremendous rate. Listing inventories have been increasing substantially. And probably the most telling of all the percentage of price reductions on listed properties have really skyrocketing. In another few months when today’s current sales start to close and be reported, you’re going to see substantial price drops that are going to continue for some time.

Sure, some people who purchased homes 3 years ago may not be too badly affected, if they haven’t pulled out home equity lines. But, people who purchased during the last two years might see its substantial portion of their artificially government created appreciation vanish, and I’m expecting a new bout of short sales to start occurring by early 2023. For me personally, the writing is on the wall, you can try to rationalize it, ignore it, or downplay it, but, with this powerful trend in place nothing is going to stop it.

Below is a headine just today:

Australian house prices fall at ‘fastest rate’ since 2008 financial crisis

By business reporter David Chau