Home Prices – Lowest Levels Since The Housing Crisis Began

Home Prices

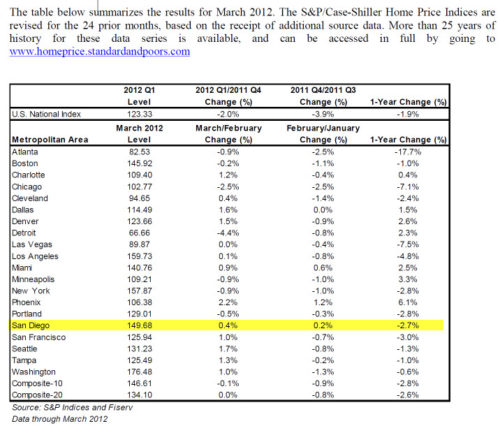

Today, the S&P/Case-Shiller 20-city composite index was released. The three-month rolling index includes transactions that took place from January to March.

Only three cities—Atlanta, Chicago, and Detroit— saw their annual rates of change worsen in March compared to year-over-year numbers reported in February. The remaining 17 cities and both the 10- and 20-city composites reported improvement in that area—though most still reported price drops—and seven cities boasted rates of change in positive territory.

With these latest data, all three composites still posted their lowest levels since the housing crisis began in mid-2006.

David Blitzer, chairman of the Index Committee at S&P Indices said: “While there has been improvement in some regions, housing prices have not turned. There are some better numbers. This is what we need for a sustained recovery, monthly increases coupled with improving annual rates of change. Once we see this on a broader level, we will be able to say the market has turned around.”

Home Prices – San Diego

For San Diego County home values, the chart above, shows we saw a small 0.4% increase for March, but were still off by 2.7% (a larger drop than the national average) for the one year home price change.

To view San Diego County MLS listings visit: http://www.brokerforyou.com/san-diego-real-estate-mls-home-listings.htm

Comments are closed.