Real Estate Market Crash

This video is about the 2021 real estate housing bubble popping, actually, if you read my prior post here this morning, this video is exactly the same only re-created in a video format to make it easy for others just to listen

Yes, today’s real estate market, has been the craziest that anyone has seen in their lifetime.

Real Estate Market Crash

I’m sure there’s some very naïve people out there, who thought this market would go on forever. But this market is a classic example of prices climbing too high too fast into unsustainable crazy valuations!

Home buyers and real estate investors have been waiting for the 2021 Housing Crash. Well, they might not have to wait for the Real Estate Bubble to burst for much longer.

Three housing market indicators: 1) new home purchase applications, 2) housing starts, and 3) lumber prices have all moved in the direction of a Housing Crash over the last month. Home buyer demand has fallen off a cliff in recent months.

Data collected by the Mortgage Banker’s Association shows that mortgage applications for new home purchases are down 25% from February to June. This means that way fewer putting are in the market for a home now compared to four months ago. In fact, the mortgage purchase application figure is now back at mid-2019 levels.

This is occurring just as home builders are beginning construction on a record amount of new homes. Over the past 12 months over 1.55 million new housing starts have occurred according to data from the Office of Housing and Urban Development and the US Census Bureau. This means that the United States will have significantly more new home inventory hitting the market in late 2021 and early 2022. On top of all this the cost of lumber, which was soaring for many months, has also started to crash. Its down 41% from its early May peak. Lower lumber prices mean that builders won’t have to charge as much to cover costs of new homes. They also mean that the narrative surrounding the housing market could shift into negative territory in coming months.

Home prices have to face a reckoning, and the more inflation pressures mount, the more obvious it gets that a housing market crash is going to happen. It now seems like the housing market may have reached a point of complete breakdown, only time will tell for sure.

Naturally, this is just my opinion, and before making any decision of whether to buy sell or invest in real estate you should always consult your legal and financial advisors.

*******************

www.brokerforyou.com *** This 21 year old San Diego real estate website is for sale! Also, aged real estate sites in many California cities are for sale.

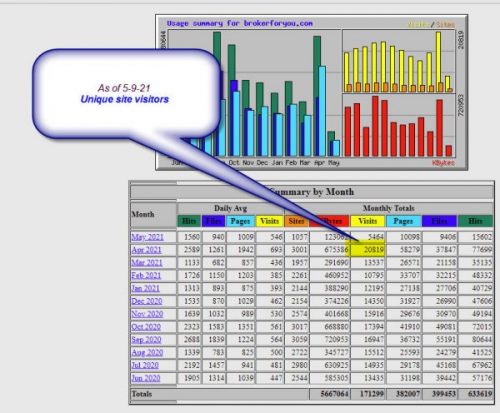

Over 20,000 unique visits in April 2021

++++++++++++++++++++++++++

Visit our Youtube San Diego real estate channel

You can thank Joe Biden and the Democrat party for the spike in inflation. Remember that the next time you vote.

Wow! How do you miss two giant factors: Forbearance and bankruptcy. The only thing preventing these two factors was the fact you couldn’t get kicked out of the home you were living in (part of the CARES act), nor did you have to pay your mortgage if you sought forbearance (24 month exception). I can tell you right now, there are bankruptcy attorneys hiring extra staff for all of the claims that are about to be filed in the next few months. People who were renting sent the landlord’s property into default and banks who had customers filing a forbearance are gearing up to have people walking away from their property. 10 – 14 million hopes in the US are currently in forbearance is not a good indicator of home values staying high. I believe you sell your home now, live with a relative for a few months and come in hard when the market dives this fall/winter.

Not sure why someone would but now unless they have so much money that losing equity doesn’t matter. Even if housing prices don’t dip in the next few years, unless you are going to stay in your house forever , would it be wise to buy a house that’s 100k overpriced and significantly lose that value?

I bout three homes last year. I just listed one of them for sale to pull out my investment money (down payments). It has a renter in it so it’s pretty much sight unseen. It listed saturday morning and by sunday at noon I got cash offer 13% (68k) over ask. I do not believe its slowing by the sheer amount of offers we got.

Just incase though I did pull out my original investment.