Exodus from Cities

Glenn Kelman, Redfin CEO, joins ‘Power Lunch’ to discuss the state of the vacation home market and where he sees it headed as the coronavirus pandemic continues.

Real Estate Exodus from Cities

1. The Exodus From Major Cities: I’ve been saying for a long time now that people will start to move out of the overpriced cities and into surrounding areas in direct proportion with the acceptance of remote working. This is nothing new, and we’re now starting to see this coming into force at a rapid rate thanks to technology like Zoom and remote working.Â

The CEO of Redfin just reported that search traffic has moved from the major cities to smaller cities and towns. Roughly 25% of now remote workers will simply never go back to working in an office as this entire situation has proven that remote working works just fine. The big cities were already losing people to the smaller cities, due to the increase of the advent of remote working. Also, as families or couples get older, they often prefer to move out of the hustle and bustle to more quiet locations such as the suburbs, or in Europe this is smaller towns and villages. Whereas we have the polar opposite with the younger generation, who want to move into apartments in the hustle and bustle of the big cities. Having a good standard of living in terms of your housing situation in the big cities is shocking. So the higher end houses in the big cities are going to get hit the hardest as people realise that they don’t need to sacrifice their living standards anymore.

2. Mass Unemployment: Housing crashes are caused by two things: 1. Rising unemployment 2. Rising interest rates. We’ve already got The Perfect Storm with the insane unemployment right now, so as soon as you see interest rates going up, that’s when you need to panic. Because things are going to get crazy at that point with quite possibly the biggest housing crash ever recorded in history. People here in California and many other cities are missing rent and mortgage payments by the millions right now.

3. Home buyers: There is more than 25% of unemployment right now just in the USA & Shadow stats actually puts this ABOVE 40%, combined with stricter lending criteria. So that takes a chunk out of the largest market of buyers, because many of these people are now priced out of buying a home. Finally, we have speculators, also known as flippers. They can’t afford to time the market wrong, or they could lose every penny of profit they would have made. So they’re also being very cautious and many of them are not buying anything right now unless it’s heavily discounted.

Conclusion: So the BIG question is: Are we still heading into the biggest housing crash our planet has ever known? Well I think this could be the case but again, depending on how the next few months play out will give us a more accurate forecast. I still don’t think we’re going to have a good picture on house prices until at least 2021. So if you’re a first-time home buyer and you’re buying a fairly small and conservatively sized house, I don’t think you’re going to be too badly affected. I do think prices will drop but not by a huge amount, and they will recover, so I wouldn’t worry about it. But if you’re buying a larger, more expensive home, yeah, personally I would wait.

I do think these prices are going to be coming down due to a lack of affordability, making it a buyers market in the near future. U.S. will see falling house prices especially in high priced states like California, Massachusetts, New York City and Washington D.C..

Naturally I hope I’m wrong, but, I think there is going to be a Global Recession unlike anything the World has ever seen. But the biggest risk we have right now is high unemployment and uncertainty in the marketplace.

DISCLAIMER This opinion article is for entertainment purposes ONLY. I am not a financial advisor or attorney. This article shall not be construed as tax, legal, real estate or financial advice and may be outdated or inaccurate; all decisions made as a result of opinions expressed here are yours alone.

################################

Looking for a great mortgage banker? For myself and my clients I use Greg Brooks.

Greg Brooks

Branch Manager

The Southwest Branch

San Diego, CA, AZ, and FL

O: 8589455626 F: 8584303196

NMLS# 151145 | Company NMLS # 3274

Equal Housing Lender

www.guildmortgagecalifornia.com

#############################################

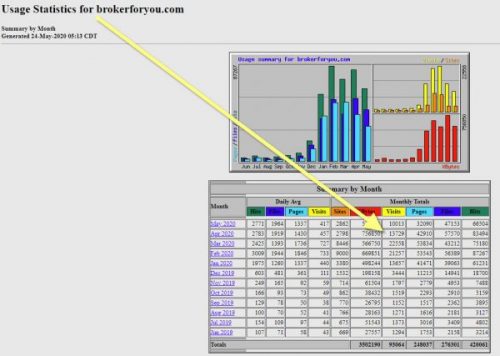

www.brokerforyou.com *** This 21 year old San Diego real estate is for sale! Also, aged real estate sites in many California cities are for sale.

++++++++++++++++++++++++++

Visit our Youtube San Diego real estate channel

Real Estate Exodus from expensive, large cities

Sharing is caring!