Housing Market – Lumber Price Crash

This is a great informative video just published today. For my new readers, I’d like to note, that I pointed this out as one of my major red flags for calling a top in the U.S. housing market back on June 17, 2001 ( https://www.brokerforyou.com/brokerforyou/real-estate-market-bust/ ). As this current video points out, it’s the same factors that caused the huge spike in lumber prices and now the crash of lumber prices, that have affected our housing prices. Also, as I pointed out, housing prices move very slowly, they not like the lumber futures market or the stock market, where you can have major moves in a couple of hours or a day or two, housing price trends always takes a couple of months to reflect the real trend or change in direction.

Ever since I called the top of the real estate market last month I see absolutely no factors that would cause me to change my opinion. Actually, I put off my search for a retirement home up in Prescott Arizona, because I am convinced that a year from now prices will be substantially lower than where they are today!

Housing Market – Lumber Price Crash

Home buyers and real estate investors have had their eye on lumber prices over the last several months. Many were proclaiming in May 2021, when Lumber Futures reached a record high, that high lumber costs were the sign of sustained inflation. And that the combination of high lumber prices and inflation meant that buying a home or real estate was still a good investment.

But lumber’s epic collapse over the last two months is calling all of the assumptions on home prices and inflation into question. Essentially, the reason lumber became so expensive was because there was a shortage in the amount of lumber supply. This was the unique result of lumber mills being shutdown when the pandemic began.

As those mills ramped up production, and as demand for lumber declines due to a decrease in DIY projects, home renovations, and additions, lumber prices collapsed.

Is a similar situation occurring in the US Housing Market? There has been a 20% decline in home listings in America according to Realtor.com over the last 15 months. This decline in listings – a combination of seller cautiousness, foreclosure moratoriums, and paused development projects, is causing a shortage in homes for sale.

But that shortage is being relieved, with a large increase in re-sale listings and home builders starting a 15-year record amount of new projects. At the same time home buyers are dropping out of the market left and right, with home buyer confidence at all-time low.

The result? Home prices could decline in a similar fashion to lumber, as the shortages turn into surpluses and prices collapse.

*******************

www.brokerforyou.com    *** This 21 year old San Diego real estate website is for sale! Also, aged real estate sites in many California cities are for sale.

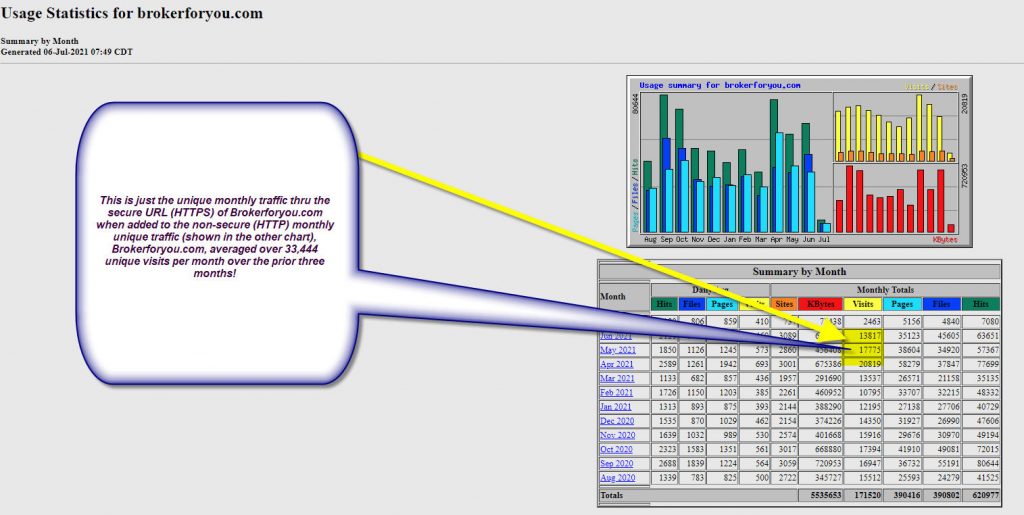

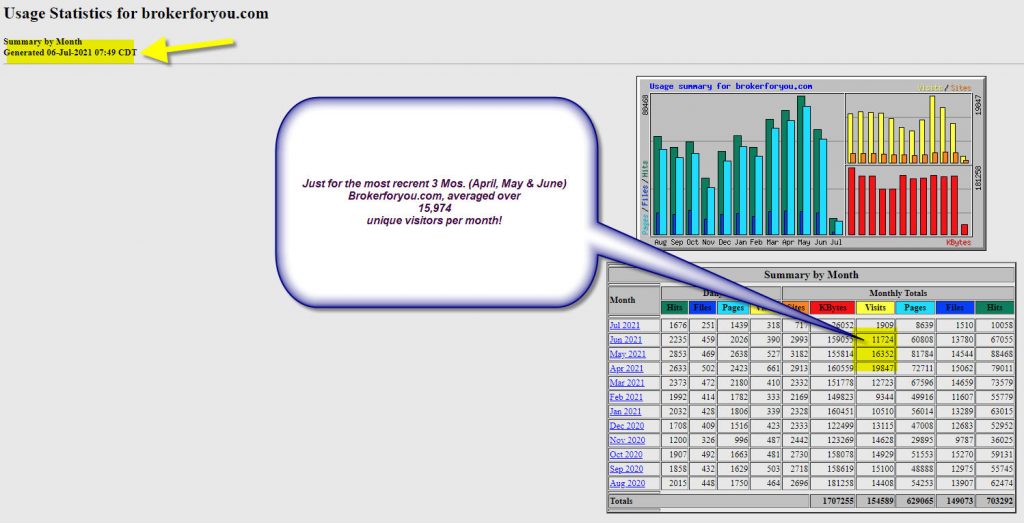

Over 33,444 average monthly unique visits to Brokerforyou.com in the last three months.

++++++++++++++++++++++++++

Visit our Youtube San Diego real estate channel