Home Affordable Refinance Program – Not All Good

HARP 2 – Lifeline for Some Troubled Homeowners?

The government is changing its Home Affordable Refinance Program (HARP), making it easier for homeowners to refinance their underwater, high-interest mortgages.

HARP 2 – Major Features

- Although HARP has helped more than 890,000 homeowners nationwide by reducing their monthly mortgage payments, there are still millions of homeowners who are too far underwater to participate.

- Under the new rules, homeowners who owe more than 125 percent of the market value of their homes will be allowed to refinance into new loans.

- The program also streamlines the refinancing process for homeowners who are current on their mortgage payments and reduces or removes fees that previously hindered them from refinancing.

- Fannie Mae and Freddie Mac also will reduce the fees they charged in the past to enable borrowers to better afford the new loans. Among the fees that will be reduced or eliminated are those for appraisals, title insurance, and closing costs.

- Fees also will be waived for some underwater borrowers who are refinancing into 20-year or shorter-term loans.

- HARP is only open to borrowers who are current on their payments for the past six months with no more than one missed payment in the past 12 months. The loans must have been originally issued before May 31, 2009, and purchased by Fannie Mae or Freddie Mac. Read more

Home Mortage Refi Program for Underwater Homeowners

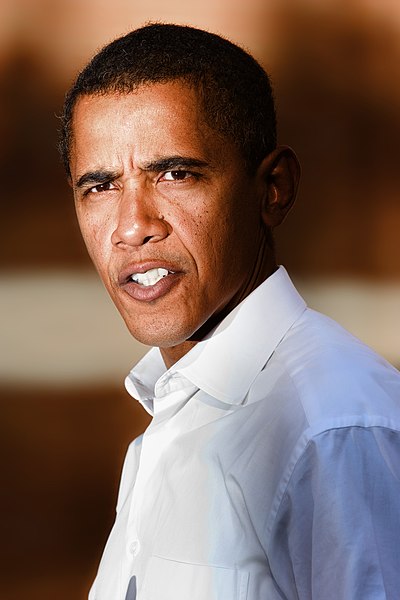

The accusation can be made that government programs never come in at their projected costs or finish on time. The government’s current Home Affordable Refinance Program is a prime example. The Obama administration’s Home Affordable Refinance Program was scheduled to end on June 10 . Now it will run to June 30, 2011, the Federal Housing Finance Agency said Monday.

The program allows borrowers, who owe up to 25 percent more than their homes are worth, to refinance to lower interest rates. Read more