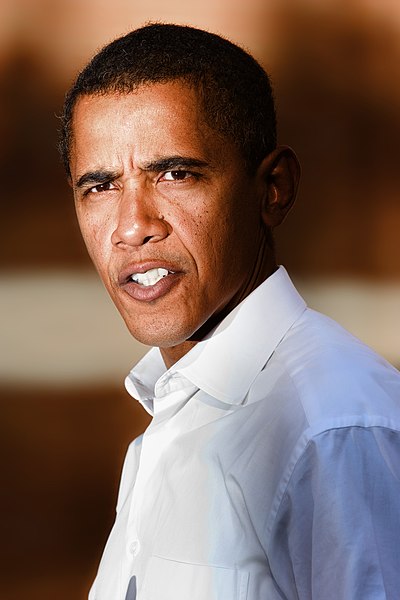

President Obama – No Friend to Home Ownership

To pay for the huge budget deficits currently being racked up by the Obama administration, taxes will be forced up and new revenue sources sought out. Right now, Obama’s current budget will reduce the home mortgage interest deductions. Of course, these ideas start with the higher earners, but rest assured, once the door is open, the earning caps will be reduced until finally eliminated!

Do you think I’m stretching the truth on this topic? The idea that elimination of the home mortgage deduction will not affect homeownership is already being actively discussed. The proponents bring up the fact that Canada, the United Kingdom and Australia all have roughly similar home ownership rates as the United States, but none provide mortgage interest tax deductions.. Plus, what a great way to further Obama’s stated goal of wealth re-distribution.

In part, here is what the Obama budget says: “The Administration’s Budget includes a proposal to limit the tax rate at which high-income taxpayers can take itemized deductions to 28 percent — and the initial reserve fund would be funded in part through this provision. This provision would raise $318 billion over 10 years.”

With the Administration’s stated intent to use any perceived crisis to push through legislation that otherwise would be political suicide, here is some of the current rhetoric surrounding home ownership:

A. Slash deductions for homeowner mortgage interest from the present $1.1 million limit to $500,000, phased in with $100,000 annual reductions starting in 2013, and extending to 2019. Under current law, taxpayers can write off mortgage interest on their principal home debt up to $100,000.

B. The maximum mortgage debt amount would shrink yearly until it hit $500,000. Over a 10-year period, this change alone would boost federal tax collections by an estimated $41 billion.

C. Replace the current mortgage interest deduction with a flat 15 percent tax credit for everyone with mortgage amounts below the declining limits in the first (A) option above. Rather than taking write-offs that are tied to your personal income tax bracket, every homeowner would get a credit worth 15 percent of mortgage interest paid.

Besides raising $13 billion in 2013, it is estimates that moving to a credit approach would increase revenue by nearly $390 billion between 2013 and 2019.

So, real estate professionals who voted for Obama, is this the “hope and change” you expected?

Comments are closed.

When a country can no longer produce wealth, the aristocracy dreams up schemes to defraud the masses of their existing funds. Its always been that way throughout history and the USA today is no different.

San Diego County real estate agents

Robert Shiller, he made his case 4 years ago for addressing housing prices, and warned that a dramatic fall in prices would lead to widespread systemic risk….read his wealth affect study….sucks to be right….

Tijuana dentists

OK America Business & Politicians…..it’s time for you idiots to get out of the way of those who have real answers to save the economy. You idiots have been in power too long. You don’t know what you’re doing trying to save those stupid banks and mortgage companies. You’ve screwed the American public out of their equity in their homes, that which was driving this economy. Threat was the “ATM” of the consumer. Let OBAMA and his team come on the field and shut down that stupid war, and put plans in place to put America back to work.

San Diego plastic surgery