San Diego neighborhood specific real estate sites for sale

Unique opportunity to own San Diego neighborhood specific real estate sites

San Diego Real estate brokers retirement presents great opportunity for astute California real estate agents and brokers!

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google; they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion – YouTube now operates as one of Google‘s subsidiaries.

YouTube’s revenue in 2013 nearly doubled and is estimated to hit $5.6 billion according to eMarketer; others estimated 4.7 billion!

As a real estate professional in San Diego California, you most probably have a website. But take a look at the traffic you’re generating from that website. From my own analysis, the majority of San Diego real estate websites just generate a couple of hundred unique views per month. To even have a chance of gaining one new client you need tens of thousands of unique views. Read more

San Diego California – Worlds Smart Cities

San Diego California one of the world’s smartest cities

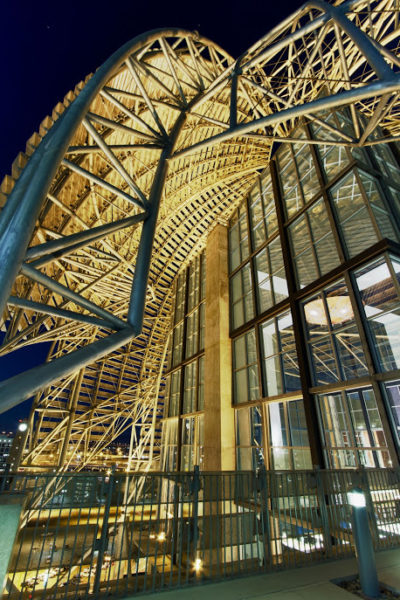

National Geographic Channel features San Diego as the only U.S. city in its acclaimed documentary series “World’s Smart Cities”. San Diego was chosen for its strong technology sector, local innovators, green practices, smart public planning and an unparalleled quality of life. Other selection factors included San Diego’s size of population, demographics/cultural diversity, livability, economy and business climate, educational institutions, leadership and strong sense of community.

National Geographic Channel’s “World’s Smart Cities: San Diego” documentary is an unprecedented exploration of the 8th largest U.S. city where technology, talent and innovation create a new urban environment – one that will emerge as a leading city in the 21st century. Read more

San Diego Neighborhoods

San Diego Neighborhoods

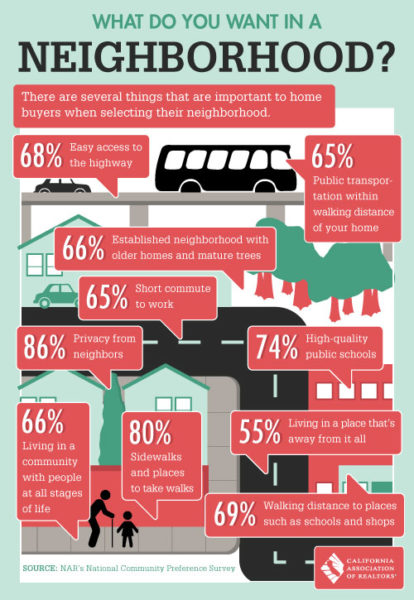

Have you ever wondered what home buyers are really looking for in a neighborhood? Most people would guess the number one thing are good schools, but,as you can see from the graphic below that’s actually number three on the priority list.

So, how do you rate your own neighborhood priorities compared to the results shown here from the national Association of realtors survey? Your comments are encouraged, below.

San Diego Neighborhoods

San Diego’s Cost Of Living

According to the Council for Community and Economic Research, San Diego’s cost of living is 32.3 percent above the national average. Among 22 major metro areas, the only places with a higher cost of living are San Francisco (62.1 percent above the national average), Los Angeles (36.2), Washington D.C. (37.9), and Manhattan (118.0). San Diego compares poorly with other high-tech areas such as Austin, Charlotte, Orlando, and Raleigh, whose living costs are all below the national average. San Jose (Silicon Valley), at 55 percent above the national norm, is the most expensive of the tech centers.

San Diego Little Italy condos

San Diego City and the State of California are in Real Bad Shape

Well, if you are a regular reader of this blog you know what a hit our housing market has taken. But, do you also know how bad San Diego’s finances really are?

Professors say that state pension fund as presently set up have only a 1 in 20 chance of paying their obligations 15 years from now, according to Barron’s.

Jumbo Financing and the Impact on The San Diego Real Estate Market

Jumbo Financing is any financing that goes ABOVE what the "agencies" will buy or insure. This basically includes any loan larger than the FNMA and FHA loan limits. There are currently very few players in this market. These players include GMAC, Chase, BofA, Wells, Citi, and a few others with less commonly known names. The issue is that these players can no longer "securitize" and sell these mortgage loans, so the loans use up their cash. In spite of being able to charge higher rates and diligent scrutinizing of the underwriting, the investors are also trying to conserve their cash positions; liquidity is king for banks right now. These investors have (nearly) all made guideline changes just in the last few week,s indicating that their appetite for the loans is slowing. We have seen investors raise minimum FICO score requirements. Chase will not finance anyone who owns more than 4 properties. GMAC has completely eliminated programs, only to reinstate some of them the next day. Citi has priced some products so high they are effectively out of the market And so on it goes. These investors now require higher down payments and are especially cautious with their lending guidelines in "declining markets" like California.

Jumbo Financing is any financing that goes ABOVE what the "agencies" will buy or insure. This basically includes any loan larger than the FNMA and FHA loan limits. There are currently very few players in this market. These players include GMAC, Chase, BofA, Wells, Citi, and a few others with less commonly known names. The issue is that these players can no longer "securitize" and sell these mortgage loans, so the loans use up their cash. In spite of being able to charge higher rates and diligent scrutinizing of the underwriting, the investors are also trying to conserve their cash positions; liquidity is king for banks right now. These investors have (nearly) all made guideline changes just in the last few week,s indicating that their appetite for the loans is slowing. We have seen investors raise minimum FICO score requirements. Chase will not finance anyone who owns more than 4 properties. GMAC has completely eliminated programs, only to reinstate some of them the next day. Citi has priced some products so high they are effectively out of the market And so on it goes. These investors now require higher down payments and are especially cautious with their lending guidelines in "declining markets" like California. Certain programs have already gone away or are going away. Right now, it is VERY difficult to finance people who are self employed, who are buying certain condos, who are investors owning more than a certain # of units, etc…

Many thanks to our guest author, Mr.Greg Brooks Southwest area manager San Diego Mortgage Network for this enlightening post. A few our prior popular posts were:

More homeowners than ever are selling at a loss!

Another Look at the June Rise in Pending Home Sales

Home Value Loss … Homeowner Perception vs. Reality

San Diego Real Estate Market Bottom?

Reworked Subprime Loans … 40% End Up Defaulting

San Diego Real Estate … The Coming Next Wave of Foreclosures

Believe the local San Diego ‘experts’ that subprime delinquencies are slowing?

The local San Diego 'experts' who are trying to jump on every tidbit of positive real estate news as proof positive that our San Diego real estate market is finally turning, may just have to re-think their recent touting of slowing subprime delinquencies.

The local San Diego 'experts' who are trying to jump on every tidbit of positive real estate news as proof positive that our San Diego real estate market is finally turning, may just have to re-think their recent touting of slowing subprime delinquencies.

Clayton Fixed Income Services, Inc released a report showing the percentage of subprime borrowers 60 or more days in arrears at the end of July surged for both the 2006 and 2007 vintages, up nearly 7% and 11% compared to June, respectively… Despite a sharp increase in cures… the number of troubled subprime borrowers… is again swelling — the 2006 vintage saw its cure rate rise 11.8%, while the 2007 vintage saw cures rise nearly 20% compared to one month earlier… A large volume of repayment plans put into place earlier this year for troubled subprime borrowers are now failing. downtown San Diego California condominiums

TECH-SAVVY SAN DIEGO

The Scarborough Research study measured the concentration of technology users with a wide range of high-tech habits, and found San Diego to be #4 on the list for most tech-savvy cities. As reported in early May 2008, about ten percent of San Diegans made the cut, ranking above the national average of six percent. The study queried high-tech habits such as blogging or watching cell phone videos.Seattle and San Francisco finished lower in the top 10, with about 9 and 8 percent of Seattle and San Francisco residents, respectively, qualifying as savvy.Ranking as the top three cities in the list were Austin, Texas, Las Vegas, and Sacramento. San Diego downtown real estate

The Scarborough Research study measured the concentration of technology users with a wide range of high-tech habits, and found San Diego to be #4 on the list for most tech-savvy cities. As reported in early May 2008, about ten percent of San Diegans made the cut, ranking above the national average of six percent. The study queried high-tech habits such as blogging or watching cell phone videos.Seattle and San Francisco finished lower in the top 10, with about 9 and 8 percent of Seattle and San Francisco residents, respectively, qualifying as savvy.Ranking as the top three cities in the list were Austin, Texas, Las Vegas, and Sacramento. San Diego downtown real estate

The Steady Rise in San Diego Unemployment

San Diego’s unemployment rate continues to be lower than California and the United States as a whole. The bad news is that it’s been on the rise since March. According to the San Diego Workforce Partnership, in March, San Diego’s unemployment was at 4%, the lowest all year, compared to 5.1% in California and 4.5% in the United States. By July, San Diego’s unemployment stood at 4.8%, while California was at 5.5% and the United States was at 4.9%. National City has been hit the hardest. Most recently the city’s unemployment rate was 9.6%. Imperial Beach’s unemployment rate was at 7.9% and the lowest rates around San Diego County were Valley Center (2.2%), Del Mar (2.3%), and Poway (2.8%). San Diego CA real estate