Mandates effect on real estate values

Mandates effect on real estate values

We are witnessing in real time the collapse of small business, small enterprise, real estate and peoples lives.

We are witnessing segregation being reborn in America. We are witnessing crime hit levels that we have never seen in our lifetimes and my fear is that this is just the beginning. Read more

Real Estate Red Flags – Wealthy Selling Their Property

Real Estate Red Flags – Wealthy Selling Their Property – Going into Rentals

The local markets are very different, so it is impossible to make a general conclusion. The FED’s data shows that the number of houses for sale on the market is increasing, so the shortage of homes for sale may be near an end. Read more

Housing Crash 2021

Housing Crash 2021

Price declines are around the corner. Home buyers and real estate investors across the country should track the progress of Boise to understand what will happen across the country in six months. Inventory and active listings are way down across the US over the last year. -25% in the typical market.

Some of the areas with the biggest declines in inventory are in the Southeast – particularly Raleigh, Tampa, and Nashville. But some areas have experienced an inventory SURGE. In particular, Boise, Idaho has had a +34% increase of inventory over the last 12 months. No other metro is even close.

Real Estate Rents Falling a new trend

Real estate rents falling

New York Real Estate has had it’s fair share of challenges thanks to the eviction moratorium, forbearances, rents decreasing, rent delinquencies and new property regulations.

Housing market slow down

Housing market slow down

Please keep in mind when watching this video that forecasting the real estate market is far different than forecasting the stock market. When you go to buy and sell stocks you can do it almost instantaneously what when you purchase real estate you usually have to go through an escrow you have to apply for a loan you have to check the title insurance have physical inspections etc. and were talking about a quick closing being 30 days average closing probably more like 45 and along closing 60 days!

Also, when forecasting a change in the real estate market, even if you’re forecast is for the entire US residential housing market, again, unlike the stock market all real estate markets are basically local. So, although calling major turning points in the real estate market will eventually affect all local neighborhoods, at the outset of these major moves, it would be very rare for all the red flags to indicate a major turning point in every local market. Read more

Evictions are Coming

Evictions are Coming

Almost 2 million people in eviction bans set to end all at once . . . this could this be the tipping point for the correction!

Real Estate Market Top

Real Estate Market Top

My first post where I called the real estate market top was June 15, 2021 (https://www.brokerforyou.com/brokerforyou/real-estate-market-downturn/ ) just a couple of weeks ago. Then, two days later on June 17 I had a follow-up post ( https://www.brokerforyou.com/brokerforyou/real-estate-market-bust/ )where I added additional indicators, that to me showed that the market was in a topping phase right now! I put the links to each one of those prior post above, and would suggest if you’re interested, to reread those posts!

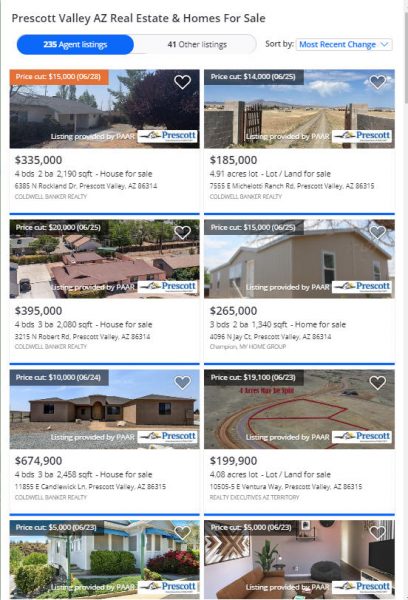

Today’s post, concerns my original indicator, changed listings that appear in the Prescott Valley Arizona area. If you look at the image above, you’ll see that for the eight listings that are shown (I could show many more just changed listings, but I don’t want to scroll down, these listings are coming up in random order), of these first eight random real estate listings that are shown, today, all eight are showing price reductions! Read more

Real estate market bust!

Real estate market bust! (Note -published June 2021)

For well over 18 months now the number one question when talking about the real estate market has been when is the market going to turn down? Naturally, there’s been lots of speculation, but until now there have not been any conclusive signs of out in our way overheated real estate market.

Two days ago I wrote a post, ( https://www.brokerforyou.com/brokerforyou/real-estate-market-downturn/ ) where I speculated that because of the large number of price reductions occurring in just one very hot residential real estate market in Arizona, it was my opinion that the entire U.S. market had topped out and is now ready for a downward move of the substantial magnitude.

Well, for the last couple days I’ve been looking for other indicators to confirm my theory. I’ve now found those indicators, and must say, without hesitation are now in the topping out phase of one of the craziest residential real estate markets that I’ve ever seen! Read more

Real Estate Market Downturn

1st signs of the Real Estate Market Downturn (Note published June 2021)

I’ve been in residential real estate for over three decades and I can tell you that major real estate market turns do not happen on a dime! If you study the residential real estate market, there are subtle signs of major market turns. Precisely because these are at first relatively minor moves, they are usually discounted or overlooked by the press and most real estate professionals. One should keep in mind that the residential real estate market professionals are not so much professional market timers – actually they probably are no better at market timing than your average dog groomer – but are just very good salespeople! Yes, the residential real estate market professionals are professional salespeople and nothing more. Read more

Commercial Real Estate Bubble

Another Real Estate Bubble?

Back in November 2016 I wrote an article about red flags that I saw pertaining to the United States commercial real estate market. If you missed that article here is the direct link: Real estate bubble 2017

Well, just this week I saw another red flag pertaining to the commercial real estate market. Yes, take a look at the photo to the left. I purchased an electronic device last Sunday from Amazon. I ordered it online about 8 o’clock in the morning on Sunday. As you can see from the bag, the online order form showed that it would be delivered between 12 and 2 PM (actually arrived at 12:30 PM) the same day. Now, as a prime member, there was no additional cost for this super quick delivery service.

I didn’t realize it at first, but the experience was so easy and so fast, I now believe that this is a definite danger for the large shopping malls. My article about the real estate bubble that I posted in November 2016 was about real estate limited partnerships (REITS) many of which invest in all types of commercial shopping centers and strip malls. So, for me personally, and I would venture to say probably quite a few other people, when ordering online, not only do you have the convenience and a very competitive price, but think of the time saved from having to go to the mall, find a parking space, fight the crowds and finally waiting at the checkout line before heading back home. Therefore, I really believe that this fast shipping service that Amazon has incorporated and I understand some other big online merchants are looking into, is going to spell big trouble for many shopping malls and thereby the REITS that invest in them.