California Real Estate Crash?

California Real Estate Crash

The hardest thing to ever predict is “When” will the markets crash. In this video, I will show you what new things are developing in the real estate and mortgage markets and we will try and take a guess to predict the timing of the next real estate housing correction.

Here are 3 major factors that discuss in depth in the video:

1. Debt Loads U.S. households are cracking under the weight of the debt they’re carrying. Household debt has risen for 23 straight quarters – and as of April, it stands at $14.3 trillion, according to the Federal Reserve Bank of New York. Auto debt’s been rising steadily for 36 months and now totals $1.35 trillion. Student loan debt exceeds $1.42 trillion. Credit card debt totaling more than $1.079 trillion just saw delinquencies rise 9.09% in April – to their highest level in two years.

California Real Estate Crash

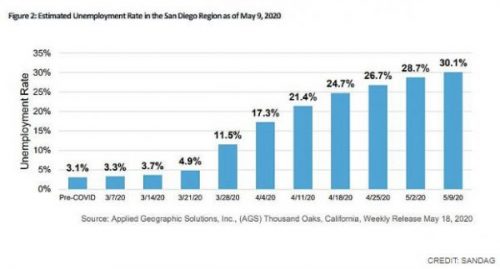

2. No Income As job losses increase and furloughs turn into permanent layoffs, households are going to have a harder and harder time paying their bills, especially their biggest monthly bill, their mortgage or rent. Since the pandemic started about 35 mil Americans have filed for unemployment taking the unemployment rate from a historically low 3.5% in Feb to about 15% today

2. No Income As job losses increase and furloughs turn into permanent layoffs, households are going to have a harder and harder time paying their bills, especially their biggest monthly bill, their mortgage or rent. Since the pandemic started about 35 mil Americans have filed for unemployment taking the unemployment rate from a historically low 3.5% in Feb to about 15% today

3. This is the big one… Mortgage Forbearance The home is the single biggest expense for most Americans – accounting for a hefty 33% of their household budget, per the BLS most recent Consumer Expenditure Survey. About three-quarters of all mortgages in the United States are federally guaranteed. The rest are private, or non-agency mortgages. The CARES Act stimulus grants relief, or “forbearance,” to homeowners whose mortgages are federally guaranteed by Fannie Mae, Freddie Mac, FHA, the VA, and Ginnie Mae Under the CARES Act, borrowers with federally backed loans are granted 180 days of forbearance, when loan payments are postponed or reduced but interest still accumulates, According to the Mortgage Bankers Association, as of April 30, 7.3% of all active mortgagors, with $841 billion in unpaid principal, asked for and got forbearance. Mortgage servicers say more than half a million mortgagors a week are adding to the growing number of borrowers not paying their mortgages, and they expect that number to increase every week for at least the next 8-12 weeks. As big as those numbers already seem to be, they could turn out to be a drop in the bucket if the St. Louis Federal Reserve Bank’s projection of 47 million Americans eventually becoming unemployed becomes reality.

Bob Schwartz Disclaimer -The above post/video is just posted on this site and the views & opinions expressed are not those of Bob Schwartz. One should always do their own investigation and talk with your own legal and financial professionals.

Be safe.

video: Disclaimer: I am NOT a financial advisor, and nothing I say is meant to be a recommendation to buy or sell any financial instrument. I will NEVER ask you to send me money to trade for you. Please report any suspicious emails or fake social media profiles claiming to be me. Don’t invest money you can’t afford to lose. There are no guarantees or certainties in trading or investing. My videos may contain affiliate links or sponsorship’s to products I believe will add value to your life and help you in trading. No matter what I or anyone else says, it’s important to do your own research before making a financial decision involving cryptocurrencies.

*******

www.brokerforyou.com *** This 21 year old San Diego real estate is for sale! Also, aged real estate sites in many California cities are for sale.

++++++++++++++++++++++++++

Visit our Youtube San Diego real estate channel

California Real Estate Crash

Comments are closed.

ðŸ‘