San Diego Home Prices – Are We At A Bottom?

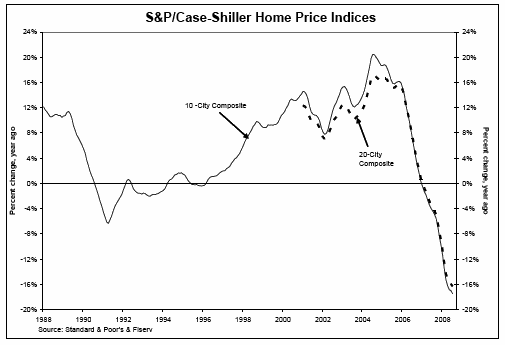

Home prices should come back to 2001 level, then we can say that the San Diego real estate market has finished it's correction.

Home prices should come back to 2001 level, then we can say that the San Diego real estate market has finished it's correction.

For now, I think the San Diego real estate market is in for a very slow recovery due to unemployment that looks like it may skyrocket. This recession is just now starting. This will further accelerate pressure on the housing sector but also later on, push interest rates higher in order for banks to recoup losses. No one has even started talking about the other wave of credit mess, Credit Card debt and the huge amount of adjustable loans issued in 2004-2005 that are set for their first adjustment in 2009. san diego real estate news

Recent Related Posts:

Stock Market Rally … A Real Bottom?

San Diego Real Estate …The Coming Up-tick

California Gives New Home Buyers $100 Million

San Diego Real Estate …The Coming Up-tick

For San Diego real estate, or for that matter perhaps all of California real estate, sales activity is about to pick up. Yes, the stars seem to be aligned for real estate buyers throughout Southern California. Will this be the long-awaited bottom to the real estate bust? Are real estate prices about to spike upward? Is now a once-in-a-lifetime opportunity to purchase San Diego real estate?

For San Diego real estate, or for that matter perhaps all of California real estate, sales activity is about to pick up. Yes, the stars seem to be aligned for real estate buyers throughout Southern California. Will this be the long-awaited bottom to the real estate bust? Are real estate prices about to spike upward? Is now a once-in-a-lifetime opportunity to purchase San Diego real estate?

Traditionally, the season from mid-March through September is the busiest time for real estate activity. Combine this with long-term fixed mortgage rates around 5%, home prices around 40 to 50% of their 2005 values, a very generous federal $8000 tax credit for first-time buyers and an unbelievable California state new home buyers tax credit of 5% or $10,000, whichever is less, and you now have a potential to see double-digit increases in Southern California real estate sales.

Now, add to the above positive factors the new California law, called California foreclosure prevention act, which becomes effective May 21, 2009. This new law, which foolishly interferes with the free market, extends the normal foreclosure. They now take an additional 90 days… So in essence, just at our seasonally strong sales time, this new state law will dramatically affect the amount of new foreclosures coming on the market. The normal supply of foreclosures will be skewed, causing the Soundbite news media to declare a huge drop in foreclosures and available housing inventories.

Once the additional 90 day for the extended foreclosure period works it way through the system (August 21, 2009), sometime in late September or early October, the news media will again be reporting an uptick in foreclosure activity.

In conclusion, if you are planning on selling San Diego real estate, now may be a very opportune time. If you are planning on buying San Diego real estate to live in, and plan to hold onto it 10 or more years, now may also be an opportune time to get into the market. Personally, with that said, I believe the real estate activity update we are about to experience will most likely be short-lived, and starting in September or October, we will see a continuation of declining real estate values in San Diego that may very likely extend until the first quarter of 2010. San Diego real estate

Recent Related Posts:

San Diego Real Estate Predictions 2009…Watch Out For The Bull!

Stock Market Rally … A Real Bottom?

National Association of Realtors Real Estate Forecast

New Law Extendeds California Home Foreclosures (again)

Though not widely publicized, the California state legislature passed a new bill which was signed by Gov. Schwarzenegger on February 20. It's titled the “California foreclosure prevention act, assembly Bill 7” and is designed to address the foreclosure problems in California.

Though not widely publicized, the California state legislature passed a new bill which was signed by Gov. Schwarzenegger on February 20. It's titled the “California foreclosure prevention act, assembly Bill 7” and is designed to address the foreclosure problems in California.

Once again, it seems our elected lawmakers are totally misguided. All this bill does is extend the normal California foreclosure by an additional 90 days. Let me clarify this a little. Back in July of 2008, the California legislature passed a bill that requires lenders, prior to filing a notice of default, to make diligent efforts to contact the homeowner to see if something can be worked out prior to the notice of actual filing of default. This provision has added at least 30 days to the typical foreclosure process in California. Normally, in California, the foreclosure process is 90 days, plus 21 days for advertising. Add the thirty days from the July 2008 provision and we now have a four month process for foreclosure, not counting the required advertising. The newest law will add an additional 90 days on top of that, so what we're talking about now is a seven month foreclosure process in California, not counting the required 21 day advertising period.

I believe this well-intentioned law will just exasperate and extend the California real estate malaise. Plus, it seems to me that our lawmakers didn't consider any of the negative aspects of extending the foreclosure process.

First of all, the last four months of sales in California have been picking up, and quite dramatically in some areas. Of course, the majority of the sales have been foreclosed properties or short sales, but the fact remains that the free market seems to be working quite well without intervention. Before extending the foreclosure process no one asked “who pays for the additional 90 days?” If the average monthly mortgage payment was $2000, who is paying for the additional $6000 in missed payments that this extension will possibly generate? Yes, it's the taxpayers who will be paying as the government buys these toxic loans.

Plus, many distressed properties in California are governed by community association groups, condos, planned unit developments and planned residential developments. All of these homeowner associations have monthly dues, which are assessed for maintenance, and in many cases, utilities. Most distressed homeowners who stop paying their mortgage stop paying their HOA at the same time as, or prior to, their nonpayment of their monthly mortgage. Typically, monthly HOA dues can range anywhere from about $80 per month to $1000 per month for a high rise condominium in downtown San Diego. With this new extension of the time to foreclose, homeowners associations are looking to be out a minimum of three months worth of dues. Because of this new bill many of these associations, already in poor financial shape due to the number of lost payments and normal foreclosures, are worse off. In many cases the only recourse these associations have is to raise the monthly dues for existing membership, to cover the loss of non-paying members.

Also, how many California mortgage lenders will want to keep issuing new loans in the state when the ability to cut their losses when things go south is now hindered by the state? At the very least, additional fees will need to be added to all California mortgage loans to compensate lenders for this un-called for interference in the free market process by the California State Legislature.

San Diego downtown condominiums

Recent Related Posts:

California Gives New Home Buyers $100 Million

New Mortgage Help for Homeowners

New Tax Credit for First-Time Homebuyers

California Gives New Home Buyers $100 Million

Are our Californian politicians screwed up or what? Can you believe that just days after passing a budget, the California legislature passed and Gov. Schwarzenegger signed, on February 20, 2009, a tax credit bill (Senate Bill 15) for taxpayers who purchase a principal residence any time after March 1, 2009, and before March 1, 2010. The allowed credit is for 5% of the purchase price or $10,000, whichever is less. The state of California allocated $100 million for this credit.

Are our Californian politicians screwed up or what? Can you believe that just days after passing a budget, the California legislature passed and Gov. Schwarzenegger signed, on February 20, 2009, a tax credit bill (Senate Bill 15) for taxpayers who purchase a principal residence any time after March 1, 2009, and before March 1, 2010. The allowed credit is for 5% of the purchase price or $10,000, whichever is less. The state of California allocated $100 million for this credit.

Although obviously well-intentioned, personally I cannot see how after raising the sales tax for the entire state, the state income tax, and the car registration fees, the state can turn around in just a few days and give away $100 million. In San Diego alone, $100 million had to be cut from the City school budget. Perhaps not giving away this new home buyer’s credit could have avoided any city school cuts!

As a Realtor, I am happy with any program that will increase sales,. As a California taxpayer I think it's unconscionable that at a time of fiscal deficits throughout the state, that this program is being instituted.

Recent Related Posts:

Home Refinance and Loan Modification Plan

The Mortgage Cramdown – A Very Bad Idea For Homeowners

New Mortgage Help for Homeowners

Stock Market Rally … A Real Bottom?

At last!! It only took a few dew drops of good news for the Dow to recover from its near death experience and rocket 350 points. The “I love America trades” of long bonds and Treasuries came back with a vengeance. The “short America trades” were last seen running down the street with their tails between their legs, and gold breaking key support at $900. News that Citigroup was profitable in 2008, rumors of the suspension of the uptick rule and mark-to-market accounting were enough to do the trick. It also helped that every technical analyst on the planet was screaming “Buy!” Although this may not last, even a single day of fresh air is welcome.

At last!! It only took a few dew drops of good news for the Dow to recover from its near death experience and rocket 350 points. The “I love America trades” of long bonds and Treasuries came back with a vengeance. The “short America trades” were last seen running down the street with their tails between their legs, and gold breaking key support at $900. News that Citigroup was profitable in 2008, rumors of the suspension of the uptick rule and mark-to-market accounting were enough to do the trick. It also helped that every technical analyst on the planet was screaming “Buy!” Although this may not last, even a single day of fresh air is welcome.

Is this stock market rally just a one day 5% dead-cat bounce? The basic fundamentals of Citi has not changed. Of course the banks will all be profitable if Uncle Sam removes any and all losses. A one-way street upward as long as the taxpayers pay the losses… a market rally based on these fundamentals does not prove to be a true bottom. San Diego Realtors

Recent Related Posts:

Eternal Optimism Meets Reality or Know When to Fold Them

The Greater Depression – Jim Rogers Interview

Real Estate Market Problems Solved

It’s the Economy That Needs Fixing Not Special Interests

Jack Welch was Chairman and CEO of General Electric between 1981 and 2001. Welch gained a solid reputation for uncanny business acumen and unique leadership strategies at GE. He remains a highly-regarded figure in business circles due to his innovative management strategies and leadership style.

Welch's net worth is estimated at $720 million.

Jack Welch says Obama needs to focus. Everything else is not only a distraction but is hurting the economy. Good analysis from a man who knows business.

[youtube]ub8urYtD294&hl[/youtube]

San Diego downtown real estate

Recent Related Posts:

Timeline of Our Financial and Housing Crisis

The Mortgage Cramdown – A Very Bad Idea For Homeowners

The Greater Depression – Jim Rogers Interview

National Association of Realtors Real Estate Forecast

For the week of March 9, 2009 – Vol. 7, Issue 10>> Home Base

INFO THAT HITS US WHERE WE LIVE Last Tuesday, the National Association of Realtors said their Pending Home Sales Index for January dropped 7.7% from December and was down 6.4% year-over-year. But an NAR index that tracks housing affordability rose to a record level in January. This was because the combination of mortgage rates, family income and home prices in January were "the most favorable since tracking began in 1970," according to the group.

The NAR also forecasted that existing home sales would rise 0.3% this year, then 5.8% in 2010. The median price would fall 4.9% this year, but rise 3.9% in 2010. New home sales would be down over 39%, with the slowdown in building and the need to trim inventory. But the median price for new homes would drop only 3% this year, then rise 4.2% in 2010. All these facts, figures and forecasts point to one thing. If people find good value and a good mortgage rate on a home they love, this is the year to buy.

Wednesday, the US Treasury released the guidelines f or its Making Home Affordable programs. The Home Affordable Refinance program will help 4 to 5 million homeowners get into a fixed rate mortgage at today's lower rates, even though their homes have lost value. The Home Affordable Modification program will help 3 to 4 million at-risk homeowners avoid foreclosure by reducing their monthly mortgage payments. Both programs will help keep people in their homes and stabilize prices. I have a summary of the guidelines and I'm happy to help people through them.

>> Review of Last Week

ROUGH RIDE… It was another week when all the major stock market indexes took a bumpy trip down, with the S&P500 at its lowest level in 12 years. The reasons were familiar…concern about the financials and uncertainty about when things will turn around for the credit markets and the economy.

The week got started with big financial player AIG owning up to a big $61 billion Q4 loss. The US Treasury responded by saying it will provide another $30 billion if needed. We also had a couple of big banks cutting dividends to save capital (actually a rather rational move in today's environment). A bunch of retailers reported declining same-store sales for February, but Wal-Mart's same-store sales rose 5.1% and they raised their dividend! We wound up the week on=2 0a disappointing February jobs report, with the unemployment rate now at 8.1%, a tad higher than expected.

It wasn't that hard to spot positive signs, although neither Wall Streeters nor the media seemed to pay much attention. Consumer spending rose in January, as did personal income. In fact, after-tax, inflation-adjusted income has now gone up three straight months. No one thinks consumer spending will explode, but the worst may be over in that department. Meanwhile, the personal savings rate increased to 5% in January, its highest level since 1995.

For the week, the Dow fell 6.2%, to 6626.94; the S&P 500 went down 7.0%, to 683.38; and the NASDAQ slid 6.1%, to 1293.85.

This time around, the bad week in stocks gave us a good week in bonds, so the benchmark 10-year Treasury's price went up. Its yield, which runs counter to price, went back down below the 3% threshold, settling at 2.823%. The mortgage rate situation continues to be very very appealing.

>> This Week’s Forecast

ALL EYES ON WASHINGTON… This Thursday the House Financial Services Committee will meet on mark-to-market accounting. Many analysts and industry groups feel that suspending mark-to-market accounting could ease capital concerns at banks. This would give them increased capacity to lend, which economists feel is key to our recovery. The cost to taxpayers? Nothing. The government suspended mark-to-market accounting in 1938 and did not reinstate it until right when this crisis began in late 2007. Hmmmmm…

Not much in the way of corporate earnings and just one significant economic report – Retail Sales on Thursday.

>> The Week’s Economic Indicator Calendar

Economic Calendar for the Week of Mar 9 – Mar 13

|

Date |

Time (ET) |

Release |

For |

Consensus |

Prior |

Impact |

|

W |

10:30 |

Crude Inventories |

3/6 |

NA |

NA |

Moderate |

|

Th |

08:30 |

Initial Jobless Claims |

3/7 |

NA |

639K |

Moderate |

|

Th |

08:30 |

Retail Sales |

Feb |

–0.4% |

1.0% |

HIGH |

|

Th |

08:30 |

Retail Sales ex-auto |

Feb |

–0.2% |

0.9% |

HIGH |

|

Th |

10:00 |

Business Inventories |

Jan |

–1.1% |

–1.3% |

Moderate |

|

F |

08:30 |

Trade Balance |

Jan |

–$38.2B |

–$39.9B |

Moderate |

|

F |

10:00 |

U of Mich Consumer Sentiment-Prelim |

Mar |

56.3 |

56.3 |

Moderate |

This post information was provided by: Greg Brooks southwest area manager San Diego Mortgage Network (800) 287-8292 x 225 San Diego homes for sale

Recent Related Posts:

San Diego Real Estate & Mortgage Views

Existing Home Sales & Values Drop in January

Real Estate ‘Insiders’ Forcasts … Dead Wrong for 2008

The Next Trillion Dollar Hole That Washington Will Be Forced To Fill

Is it time to require the taxpayer to bailout city and state pension funds across the country?

Is it time to require the taxpayer to bailout city and state pension funds across the country?

Poor management, the stock market drop and worst of all built growth projections that were not only unrealistic but pure fantisty, should more than qualify these funds for prudent taxpayer money!

Recent Related Posts:

Timeline of Our Financial and Housing Crisis

The Greater Depression – Jim Rogers Interview

Eternal Optimism Meets Reality or Know When to Fold Them

Home Refinance and Loan Modification Plan

The Obama Administration released detailed guidelines for homeowners to help them determine if they qualify for the Administration’s new Making Home Affordable plan to stem the current tide of foreclosures and stabilize the nation’s housing markets.

The hyper-links below will help the reader with some of the major questions dealing with this new homeowners program:

To find out if you qualify for either the Making Home Affordable Refinancing Program or the Loan Modification Program please click on the appropriate link below:

Find Out If You Qualify For the Making Home Affordable Refinance

Find Out if You Qualify For the Home Affordable Modification

Please find a list of useful resources below:

Making Home Affordable Summary of Guidelines

Making Home Affordable Borrower Q&A

Making Home Affordable Detailed Program Description

Home Affordable Modification Program Guidelines

Press Releases

Treasury Press Release

Fannie Mae Press Release

Freddie Mac Press Release

Important Contact Information:

Fannie Mae

– 1-800-7FANNIE (8am to 8pm EST)

– www.fanniemae.com/homeaffordable

Freddie Mac

– 1-800-Freddie (8am to 8pm ESP)

– www.freddiemac.com/avoidforeclosure

In addition, the Government warns homeowners to beware of foreclosure rescue scams:

– There should never be a fee charged for information or assistance regarding the Making Home Affordable Program.

– Beware of anyone who says they can "save" your home if you sign or transfer over the deed to your home. Do not sign over the deed to your property to any organization or individual unless you are working directly with your mortgage company to forgive your debt.

– Never make your mortgage payment to anyone other than your mortgage company without their approval.

San Diego California real estate agents

Recent Related Posts:

New Mortgage Help for Homeowners

San Diego Real Estate & Mortgage Views

HOME EQUITY CASH-OUT AT EIGHT-YEAR LOW

Timeline of Our Financial and Housing Crisis

It's ironic that excess spending (buying homes well beyond any realistic debt to income ratios, home equity loans exceeding 100% of value, etc.) got the economy into this mess and now many believe unbelievable excess spending will get us out of this depression.

But, far more ironic is the fact that the same politicians that were warned about just this situation, and chose to ignore the warnings, are the very people now still in power who are saying they have the right ideas on how to fix the problem.

[youtube]cMnSp4qEXNM[/youtube]

Recent Related Posts:

The Greater Depression – Jim Rogers Interview

Eternal Optimism Meets Reality or Know When to Fold Them

Housing Bust –Ideas to Cure & Prevent in the Future