San Diego Townhouse Rental

Lg. 2Br+FamRm/2.5Ba San Diego Townhouse Rental – SDSU Townhome Rental

*NOW RENTED*Â Modern style Spanish townhome for rent.

Attached two-car garage with direct access into the home. Also, there is a very convenient and separate laundry area off of the garage. Both gas and electric hookups for your washer and dryer. Double wall construction and dual pane glass windows provide energy conservation and excellent soundproofing. great location, surrounded by the 5,700 acre Mission Trails Regional Park!

This rental is available immediately and has just been professionally cleaned. There is a mandatory one-year lease, and credit and employment check for each occupant. Sorry, but no pets are allowed and no smokers Read more

Popular San Diego Real Estate Site

Popular San Diego Real Estate Site

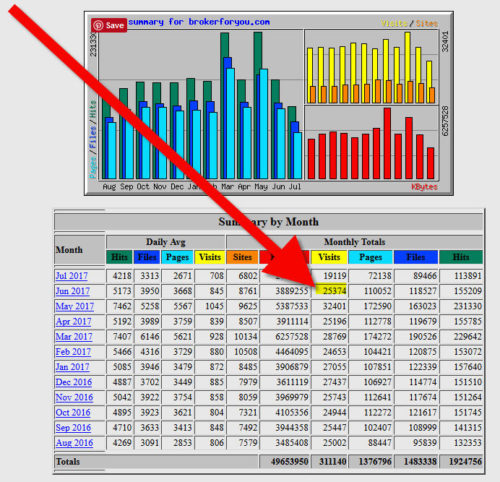

In June 2017 this site had over 25,000 unique visitors!

I like to say thanks again to all my visitors and readers of this San Diego real estate blog site.

I try to keep my posts interesting not only to prospective San Diego residential real estate buyers but also for current homeowners here in San Diego California. Read more

Housing Bust – Who Really Lit The Fuse & How To Cure It!

There has been lots of finger pointing and conjecture over whom or what started our housing melt-down. Was it social engering, Democrat favoritism, Republican lack of regulation, or something else?

I believe the question can be put to rest by facts from one of the most liberal newspapers, the venerable New York Times. On September 30, 1999, the New York Times ran a story by STEVEN A. HOLMES, titled: Fannie Mae Eases Credit to Aid Mortgage Lending. I’ll quote a few key parts of this story that will illuminate the true cause of our current housing/economic bust:

“In a move that could help increase home ownership rates among minorities and low-income consumers, the Fannie Mae Corporation is easing the credit requirements on loans that it will purchase from banks and other lenders.”

“Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its’ phenomenal growth in profits.”

''Fannie Mae has expanded home ownership for millions of families in the 1990's by reducing down payment requirements,'' said Franklin D. Raines, Fannie Mae's chairman and chief executive officer. ''Yet there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market.''

“In moving, even tentatively, into this new area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980's.”

As we all now know, the prior quote from Mr. Holmes’s article proved to be quite prophetic. Quite prophetic.

It seems ironic that a Democratic administration put us on the melt-down path, and now another Demetronic administration with a number of the same lawmakers still in place, is devising a plan to pull the economy out of the second worst economic decline in history.

The housing market is now at the center of our economic woes. However, housing does not need a knee-jerk government response of throwing billions at it with hope of turning it around, or at least finding a bottom. In San Diego, CA and other ‘bubble’ cities, we have seen a marked pick up in home sales over the past few months. I attribute this to two main factors: exceptionally low mortgage rates combined with many bank owned/foreclosed homes priced to move.

On October 1, 2008, I published a blog post entitled #1 EZ Fix to The U.S. Housing Market. This was my simplistic, but in my opinion, a totally effective way to stop the declining home values and build a base for future housing appreciation. Further. we can do it without direct government expenditures. Below is what I said in that post. I still believe that it would work today, especially in light of the natural pick up sales over the past few months:

The U.S. government’s Wall Street bailout package, or should I use the PC correct term of “Government Rescue Program,” is not only a bad deal for the U.S. taxpayer, but in my opinion, totally unnecessary.

Last week, the largest Savings and Loan in the United States, Washington Mutual, was taken over in one day in a very, very smooth transaction. Combine that with the fact that in most real estate boom cities last month, real estate sales showed a dramatic increase. Of course the increase was due mainly to buyers purchasing bank owned and REO properties, but these two examples show that our free economic system works. When the price is right, buyers will step up and in many cases, purchase properties above the current asking price.

I think the general public, and Realtors in particular, have to a acknowledge that the boom years of 2000 to 2005 took real estate prices to artificially high levels due to the easy money, easy loan qualifying standards. Rather, should I say “lack of credible standards?” Now we are going through the payback period.

For the government to come in now with this huge bail-out, would just prolong the housing decline. I would rather see the government stand aside and let the market forces determine the true area average home selling prices.

For those who think a government intervention is the only way out, I would say do it without direct taxpayer money. The undisputed key to this recovery is housing. If the government truly wants to ignite a fire under the housing market, I personally would propose a very simplistic approach that would have immediate results.

The government should pass a bill that allows any home purchaser, owner-occupied or investor buyer, who buys a residential property within the next two years and holds that property for a minimum of three years (and a maximum of ten) to be free of federal capital gains taxes upon selling the property. The potential, tax-free profits on my idea would be a huge incentive for investors to jump back into the residential housing market. This increased demand would clear the built up housing inventory in a matter of months for most areas.

If the government is going to rescue anyone with this new bill, the rescue efforts should be directed not at Wall Street, but at Main Street. The problem today is declining home prices and the built-up inventory of properties for sale. Many buyers are standing on the sidelines. Most investors are totally out of the real estate market. My proposal will solve these problems without spending taxpayer funds. San Diego real estate market blog