Vacant Housing Inventory

Vacant Housing Inventory

The deluge of Inventory could be worse than the Subprime Housing Crisis in 2008.

Real estate investors are unloading vacant home inventory on the US housing market.

Vacant Housing Inventory

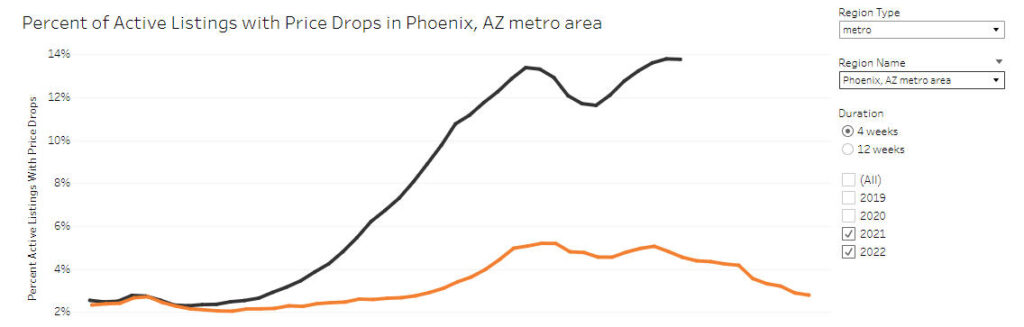

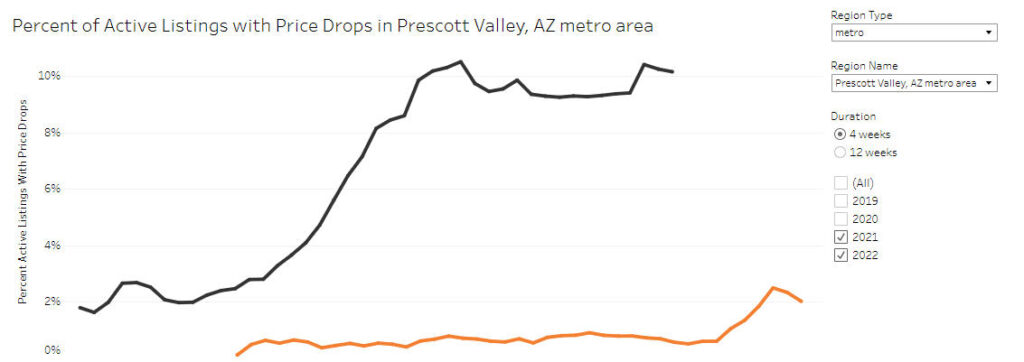

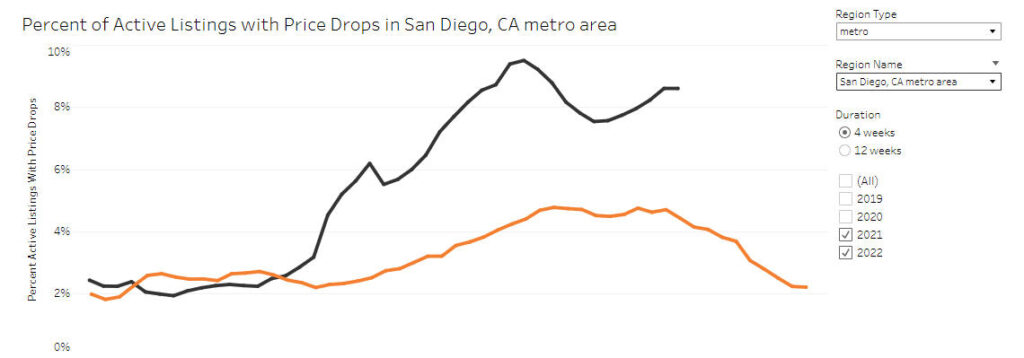

Let’s look at the latest data on the housing market in Phoenix, AZ, Prescott, AZ & San Diego, CA:

#######

#######

#######

Based on data from Zillow, both Homes For Rent and For Sale are surging on the US Housing Market. A signal of the Double-Barreled Housing Crash that is causing big problems for Real Estate Investors.

These Investors have started to sell their portfolios. And these sales could eventually cause a Subprime Crisis 2.0, were there is an unstoppable deluge of homes that hits the US Housing Market causing Home Prices to Collapse by even more.

Markets such as Phoenix, Atlanta, Dallas, Charlotte, and Jacksonville are most in the crosshairs of this investor crash because there is such a high share of Wall Street Investors buying there.

U.S. Home Mortgage Rates Rise Past 7%

The average rate on 30-year mortgages, the most popular kind among Americans, rose to the highest level since 2002, tracking the Federal Reserve’s aggressive campaign of interest rate increases.

Yes, interest rates on 30-year fixed-rate mortgages rose to 7.08 percent this week. That rate is up from 6.94 percent last week and 3.14 percent from this time last year. This is the first time that the closely watched Freddie Mac survey surpassed the 7% level in two decades!

Existing home sales in September fell nearly 24 percent from the previous year, according to the National Association of Realtors. It was the eighth consecutive month of declines.

The rise in home prices has also started a swift deceleration. The S&P CoreLogic Case-Shiller National Home Price Index, which tracks single-family home prices, rose 13 percent for the year ending in August, compared with a 15.6 percent increase in July! This decline — of 2.6 percentage points, between those two yearlong periods is the steepest drop in the history of the index, which dates to 1987!

Craig J. Lazzara, a managing director at S&P Dow Jones Indices, said in a statement, “These data show clearly that the growth rate of housing prices peaked in the spring of 2022 and has been declining ever since.”

According to Black Knight, a data firm that tracks the mortgage market., the volume of home mortgage interest rate locks in September, that is, when applicants lock in a particular rate, fell nearly 60 percent from the same month last year! Home interest rate locks on purchase mortgages, were down nearly 30 percent, while refinancing activity was also down by 93 percent!

Homeowners should understand, that just because you don’t have to sell at any time in the near future, you’re going to escape this downturn. Just like many didn’t sell their homes as prices escalated, yet their homes became worth more because of demand. In today’s market, the same is true, now lower sold prices turn into depreciation for existing homes.

Always keep in mind, that purchasing or selling a home is a major lifestyle decision, and as such, should not be rushed into. So, by all means, if you’re considering purchasing or selling real estate in today’s market, do your own homework and draw your own conclusions! But, also consult with your legal & financial advisors prior to making your moves.

My opinions here are just that, opinions! The fact that I’ve been in the residential real estate market for over three decades, does not mean that my opinions are going to be any more accurate then your mother-in-law’s opinion, though I sure hope they are!

#######

-

Brokerforyou.com is for SALE

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google, they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion! YouTube now operates as one of Google’s subsidiaries.

www.brokerforyou.com is for sale and is offered with a very popular San Diego residential real estate channel with 1.16K subscribers and 114 videos!!

What’s the approximately monthly cost to host a website? With shared hosting, you’re hosting fee can break down to about 10 to $15 per month. To keep your url registered (that’s your site address), this is usually paid on a five to 10-year basis, which averages out to about just a dollar per month! Naturally, if you add direct hook-up to a MLS database, that provides lead capturing, this costs can vary greatly from provider-to-provider.

Interested, call Bob Schwartz (619) 286-5604 for additional information

-

#######

home water leak detector – https://flumewater.com?grsf=w79pta

+++++++++++++

Great DRONE Value

Comments are closed.