San Diego Home For Sale – Just Listed

Just Listed

Best Buy – San Diego home for sale

Three Bedroom – 2.5 Bath +Fam. Rm

San Carlos Spacious (1,800+’) Townhome

For further details, please click: San Diego home for sale

San Diego Home Prices Drop … Double Dip for California Housing

Single-family resale houses were down 1.9 percent to $368,000 from March to April but up 13.2 percent from April 2009’s $325,000; resale condos were down 3.5 percent to $220,000 but up 20.9 percent from last year’s $182,000. California home sales have been leveling out, the median price of homes has pulled back from the $300,000 threshold that was crossed in late 2009, along with reports on weakness in the national numbers and the large numbers of distressed sales across the board, the front and center question is: Are we headed for a double dip? Read more

San Diego Home Values Jump Up 13 percent

In a just released report, MDA DataQuick showed that from January 2009 to January 2010 the San Diego median home price increased 5.6 percent, to $322,000. But, the real news is that on a year-over-year basis, median home price was up by 13 percent! As for the number of homes sold in San Diego, year over year, the amount was off 0.3%.

To me, a 13% San Diego home appreciation year over year would be more believable if it was negative 13%! It seems that in San Diego, the homes under $400,000 are selling quite well. The mid to upper end homes are are still languishing. Many investors are getting back into the market usually with all cash offers on lower end homes that can show a ‘better than CD ‘ rate of return. Other factors to consider are that the government buyers incentives end on April 30 and this, just like the Cash for Clunkers program, may be pulling from later in the year sales. If this is the case, we could see a marked slowdown starting in May. Read more

San Diego Home Foreclosures Jump 41.9%

Although default notices dropped to their lowest level in more than a year in December, MDA DataQuick reported yesterday, the number of foreclosures rocketed up for December, up 41.9 percent from November and up 20.9 percent from a year earlier.

DataQuick president John Walsh said.“Clearly, many lenders and (loan) servicers have concluded that the traditional foreclosure process isn’t necessarily the best way to process market distress.â€

San Diego Home Sales and Home Values Improving

Both San Diego home sales and home values are improving according to La Jolla- based MDA DataQuick. Home sales in San Diego County rose by 17.8 percent in November, compared to the same month a year ago, while prices rose by 6.6 percent.

A total of 3,148 homes sold in November, up from 2,673 for November 2008, while the median price of a home in San Diego County last month was $325,000, up from $305,000 in the same month a year ago.

Sorrento Valley California real estate

San Diego Real Estate … Time to Buy?

As San Diego home values plummet. The industry and almost all media outlets are proclaiming “It’s the time to buy! “ But, keep in mind this is almost an exact reply of the ‘news’ that was being proclaimed last year, and two years ago, and three years ago etc. Why, even in 2006 after the downturn was well under way, the ‘Indusrty’ line was “It’s a normal pull-back, creating a great buying oppurnity.”

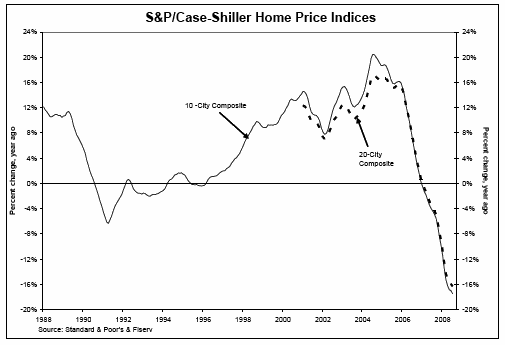

Lot’s of flippers and investors were buying all through 2007. They are in deep trouble right now. Look at the graph below which we originally published on 9-26-09.

It may be that San Diego home values need another 10%-20% drop before a real bottom is reached. In a depression, home value of homes could fall 50% from where they are today. At least, that’s what happened in the great depression.

It is very tempting to rush out and buy investment properties. But it seems it’s still too early for that.

Chula Vista real estate

Busting of the San Diego Housing Myth

“You can not lose if you purchase a San Diego home.” This was the conventional myth for many decades, but, as we all now know, it was just that…a myth! Your home is the best investment most can make…Really? Brett Arends had a simular article in the Wall Street Journal. Here is an excerpt:

Conventional wisdom long held that home ownership was a route to wealth, and the imputed rent — in other words, the right to live in your home — was just part of the value you got from it. Under that widespread view, the recent housing bust was simply a temporary, though deep, pothole.

Yet for very many people, even over the past 15 or 20 years, the imputed rent may have been all, or nearly all, the real value they actually got from their home.

San Diego homeowners and for that matter all California homeowners are being forced to face our new real estate reality… though the possibility for future San Diego real estate appreciation exists, prospective homeowners should be more concerned with a suitable place to live, and consider any appreciation as a possible, but not assured additional benefit.                                                      San Diego California real estate agents

San Diego Homes – WHEN IT PAYS TO LET THEM FORECLOSE!

A recent research report from the University of Chicago’s Booth School of Business  and  Northwestern University’s Kellogg School of Management reports that of the large number of mortgage defaults across the country, 26% were what they call strategic. This report defines strategic as one in which the mortgage default was a calculated, done by homeowners who have the money to make the payments. The owners decided that the homes negative equity position indicates to them it would be economically wiser to let the property go back to the lender.

According to another nationwide study, 22% of all homeowners had negative equity positions during the first quarter of 2009. This means the homeowners owed more on their mortgage, than the current resale value of their homes. In some parts of Southern California, Nevada and Florida, it’s speculated that more than half of all homeowners now have negative equity.

Currently, we are just beginning of prime adjustable-rate loan activity called mortgage resets. The number of these mortgage resets far exceeds the number of subprime loans. The findings from Northwestern University’s study seem to indicate that the U.S. housing market is on the brink of another substantial rise in home foreclosures.

Keep in mind, that these are prime loans made to the middle and upper end of the housing market. The people can afford to make the reset payments on their mortgages. A main reason that these people can afford the new reset payments is because of today’s low interest rates hovering at around just 5%.  In a post, dated 1-20-09, titled ‘San Diego Negative Home Equity’ on my San Diego real estate market blog, I speculated about this exact situation. The post was well in advance of this study’s findings and all the more prophetic today.

I believe the importance of the mortgage reset will wake up homeowners to the harsh reality, and extent, of their negative equity position. Will they want to keep making mortgage payments? Would you, if the current value of your home was $50,000 less than the balance of your mortgage? What if your home value was $100,00, $200,000 or even $300,000 less than the balance on your mortgage? Would you continue to make payments or let the bank take it over?

I recently sold only in La Jolla. That was purchased new in 2005 for approximately $1.6 million. My buyer, was able to buy this home for just $1.1 million. So, in just about three years, from the time this home was purchased, the original seller’s home value had declined by $500,000, or just over 31%. Now just imagine if this home was originally purchased with a 10% down payment. The original owner would have had $160,000 invested in the property at the start. Plus would have made three years of substantial monthly mortgage payments, plus upgrades and then found out that his original $160,000 equity position had deteriorated into a -500,000 position. Now, should the original purchaser, with the loan balance of $1,440,000 continue to make mortgage payments or let the bank take the property back?

In the Northwestern University study, among those without moral reservations, 63% of those homeowners with a negative equity of $300,000 or more would let the property go into foreclosure. For the other group in the study who had moral issues with letting their home go into foreclosure, if they could make the payments, 38% would let their properties foreclose if their negative equity position reached $300,000.

Another finding in the study showed that the higher number of foreclosures in the zip code, the higher the homeowners’ willingness to walk away from their properties. Plus, 82% of homeowners in the study were likely to have a strategic default when they were aware of others who had defaulted.

The bottom line from this study seems to show that the traditional assumptions that homeowners default on their mortgages because they can’t afford their monthly payments, needs to be re-examined. Even with the new Fannie Mae and Freddie Mac 125% refinance mortgages, will these deep in negative equity homeowners really be enticed to refinance their homes, when financially, it looks like a foolish decision?

San Diego Home Prices – Are We At A Bottom?

Home prices should come back to 2001 level, then we can say that the San Diego real estate market has finished it's correction.

Home prices should come back to 2001 level, then we can say that the San Diego real estate market has finished it's correction.

For now, I think the San Diego real estate market is in for a very slow recovery due to unemployment that looks like it may skyrocket. This recession is just now starting. This will further accelerate pressure on the housing sector but also later on, push interest rates higher in order for banks to recoup losses. No one has even started talking about the other wave of credit mess, Credit Card debt and the huge amount of adjustable loans issued in 2004-2005 that are set for their first adjustment in 2009. san diego real estate news

Recent Related Posts:

Stock Market Rally … A Real Bottom?

San Diego Real Estate …The Coming Up-tick

California Gives New Home Buyers $100 Million

San Diego Homeowners with Underwater Loans

People might have got into these loans without thinking too hard but I guarantee you that they won't leave as foolishly. You don't need to be Robert Shiller to understand that your housing equity is not coming back any time soon and that rents are becoming ever more affordable.

People might have got into these loans without thinking too hard but I guarantee you that they won't leave as foolishly. You don't need to be Robert Shiller to understand that your housing equity is not coming back any time soon and that rents are becoming ever more affordable.

Besides… who needs a credit score in the next 4 years anyway? Many people approaching 800 on their FICO are still being denied new credit card offers and have no desire to purchase any real estate until the dust settles.

Many strongly believe that underwater homeowners should walk away en masse unless their true desire is to stay put for the next 15 to 20 years. Rip the band-aid off!!! San Diego Realtor