San Diego Real Estate Market Analysis

San Diego County Residential Real Estate Market Analysis: 4th Quarter 2017

By Mark A. Melikian California Certified Residential Appraiser appraisals@san.rr.com P.O. Box 3051 Del Mar, California 92014 858-945-8996 ©2017

The following is a market data summary of detached and attached properties as reported by the San Diego County MLS system. The data includes all zip codes in San Diego County. All projections discussed in this analysis will be updated throughout the year in subsequent quarterly reports.

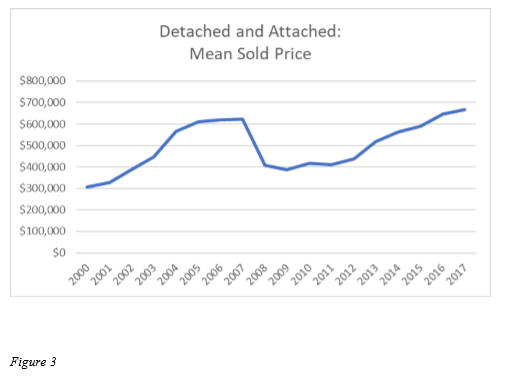

Market Overview: The data provided analyzes residential real estate sales beginning in the year 2000, which is used as the base year. The number of sold listings in San Diego County peaked in 2003 at 42,746 units and decreased through 2008 to 23,972 units. In 2017, the total number of units sold for the year was 35,200, down from 36,236 sales in 2016 (see Figure 1).

San Diego Real Estate Market Analysis

San Diego Real Estate Market Analysis

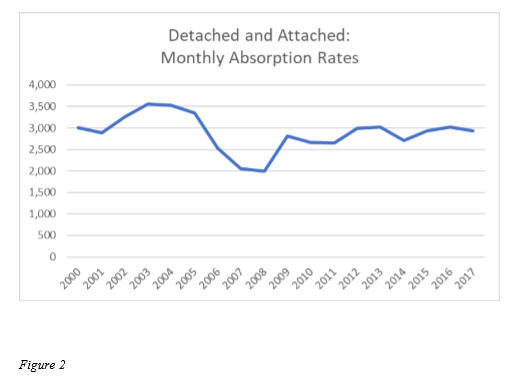

Market Overview: The monthly absorption rate (number of units sold in a month) will mirror the trend we see in the number of sold listings. The peak monthly absorption rate occurred in 2003 with 3,562 units selling per month. In 2008, the monthly absorption rate decreased to a low of 1,998 units. The 2017 monthly absorption rate was 2,933 units, down from 3,020 units in 2016 (see Figure 2).

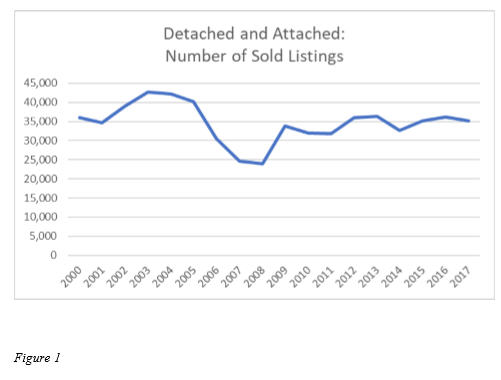

Market Overview: The mean sold price for a housing unit in San Diego County peaked in 2017 at $666,903, surpassing the previous peak of $646,201 in 2016. The current mean sold price reflects a 3.2 percent increase over last year’s mean sold price (see Figure 3).

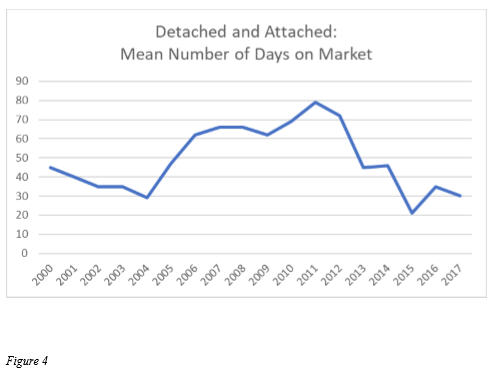

Market Overview: The mean number of days a property was on the market in San Diego County was 30 in 2017. In 2011, that number peaked at 79 days on market. In 2015, the number of days on market hit a low of 21. The 2017 number decreased by 5 days from 2016 when the number of days on market was 35 (see Figure 4).

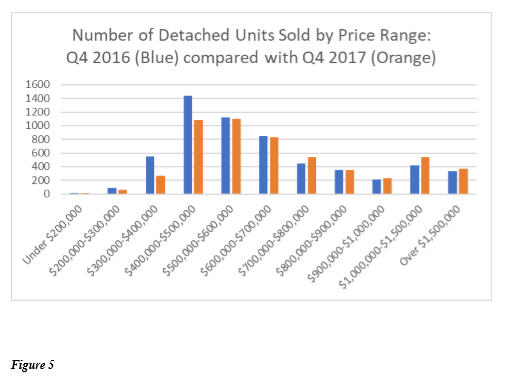

Detached Housing Market Specifics – 4th Quarter 2017 compared with 4th Quarter 2016: Detached home sales data for the 4th quarter of 2017 shows the highest number of sales were in the $500,000-$600,000 price range (1,105 units). This is an upward shift from last year when highest number of sales for the 4th quarter of 2016 were in the $400,000-$500,000 price range (1,444 units – see Figure 5).

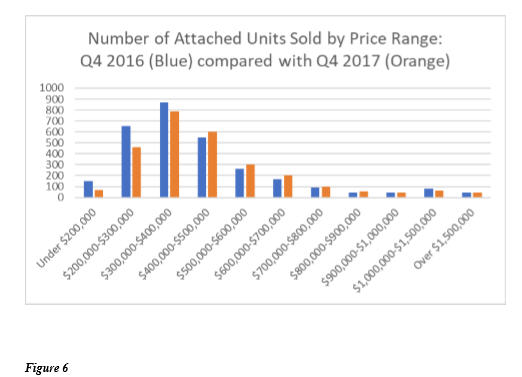

Attached Housing Market Specifics – 4th Quarter 2017 compared with 4th Quarter 2016: Attached home sales data for the 4th quarter of 2017 shows the highest number of sales were in the $300,000-$400,000 price range (786 units). The highest number of sales for the 4th quarter of 2016 were in the same $300,000- $400,000 price range (871 units) (see Figure 6).

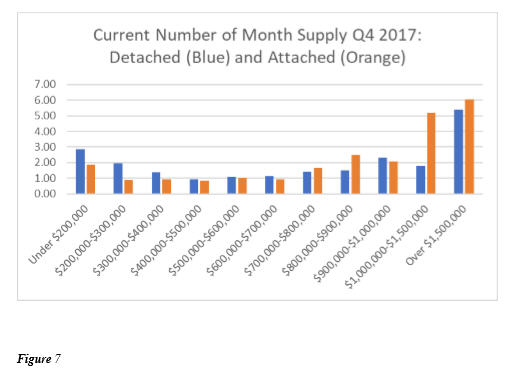

Detached and Attached Housing Market Specifics – 4th Quarter 2017 Housing Supply: Normal residential real estate markets typically have a six to seven-month supply of housing inventory. Based on 4th quarter 2017 absorption rates, current supply levels for detached properties are at (or below) normal market levels across all price ranges. Similarly, current supply levels for attached properties are at (or below) normal market levels across all price ranges (see Figure 7).

San Diego Real Estate Market Analysis

Comments and Outlook: In 2017, the San Diego County housing market’s sales prices increased by 3.2 percent over those of 2016. The county’s mean sales price reached a new high, surpassing the previous high set in 2016 (see Figure 3). Sales volume, absorption rates and days on market decreased, year over year (see Figures 1, 2 and 4).

Inventory levels decreased across all price ranges and property types in the fourth quarter of 2017 compared with inventory levels in the third quarter of 2017, continuing a trend from the third quarter of the year. Accordingly, the supply levels of active listings across all price ranges remain at relatively low levels (see Figure 7).

The highest concentration of detached housing sales includes inventory priced below $600,000 (see Figure 5). The highest concentration of attached housing sales includes inventory priced below $500,000 (see Figure 6). Most sales activity continues to remain in these relatively lower price ranges, which is largely comprised of entry level housing.

Housing supply is below normal levels in all price ranges which will likely cause a continuation of a competitive environment for buyers during the first quarter of 2018, assuming interest rates remain relatively stable. Many real estate professionals continue to report multiple offers on entry level listings with a continuation of a two-tiered market: Multiple offers are being reported on fixer properties which have the potential for renovation and resale. Multiple offers are also being reported on renovated houses that are priced competitively. Subsequent reports will continue to analyze the trends in local housing supplies, sales volume and sales prices.   ©2017

———————-

Publisher’s note: Here is a link to view my 2018 San Diego real estate market Outlook

For information about San Diego California, visit the city’s official website.

San Diego Real Estate Market Analysis

Comments are closed.

More propaganda. Does stupidity have limits? Apparently not. Housing is in a dangerous bubble and is ripe for a pop.

To think people are buying these homes for over a million dollars and they aren’t even that good looking. Here in Arkansas we’re getting some nice ass homes built. 2+ acres, 4-5 bedroom, 4 bath for not even over $500k.