Real Estate Home Sales COLLAPSE

Real Estate Home Sales COLLAPSE

Just last week, the National Association of Realtors reported a 20% YoY Decline in Home Sales to the lowest level in a decade.

Another sign that the 2022 Housing Crash and Housing Recession is getting worse. The decline in Home Sales is reminiscent to what occurred at the start of the 2022 Housing Crash. Especially in Housing Markets like Las Vegas, Phoenix, and Los Angeles, where data from Redfin shows that both Sales and Prices are down significantly over the last 2 months.

Real Estate Home Sales COLLAPSE

Something to remember that this is also a Global Housing Crash. Home Prices are not only going down in America, but also countries like China and New Zealand.

The global nature of this Housing Downturn likely means that the Crash will be longer and more severe than anticipated. The only other 2 Global Housing Downturns were in the Great Depression and Great Recession.

Home Prices are even starting to go down in a Housing Market like Miami. Median Sale Prices in Miami are down by 3% in the last two months even though Inventory is still well below pre-pandemic levels. Other Florida Markets like Orlando and Cape Coral are also experiencing declining prices.

Interestingly – the Northeast Housing Market is still hot. Metros like New York, Boston, and Philadelphia still have inventory levels and prices have not gone down by too much. I suspect there might be a shift in migration back from the South to the Northeast.

Plus – Foreclosure Starts are up by over 150% YoY as Banks are working through the Foreclosure Backlog built during the pandemic.

These foreclosures are going to hit Housing Markets like Riverside, Phoenix, and Atlanta hardest.

One reason I believe these Foreclosure are going to be worse than anticipated is because of all the BAD LOANS across the US Housing Market.

Homebuyer Downpayments have been consistently declining over the last 50 Years while Debt to Income Ratios have been rising. In fact – Homebuyers are putting less money down today than they were at the peak of the 2006 Subprime Bubble.

During the pandemic the US Government stopped these defaults from turning into foreclosures by enacting the Foreclosure Moratorium, which restricted banks from foreclosing on defaulted borrowers. But now the Moratorium is gone, and there will be a wave of homes that hit the market via Short Sale, Auction, and Pre-Foreclosure.

CHINA Real Estate – China’s Housing Crash Will be Far Worse Than You Think

China created 65 million empty homes because of two reasons. Reason one: it is the policy for developers to build within one year after project approval. Two: the CCP used the over development to over inflate( read as lie) about their actual GDP so that farmers and fisherman could become wealthy tycoons. After which they used the money they made to buy legitimate businesses and real estate outside of China and turned their lies into a giant money making machine. The CCP was in on it as they had a lot to gain from this and I seriously hope it blows up in their faces without causing too much damage to outside markets.

Always keep in mind, that purchasing or selling a home is a major lifestyle decision, and as such, should not be rushed into. So, by all means, if you’re considering purchasing or selling real estate in today’s market, do your own homework and draw your own conclusions! But, also consult with your legal & financial advisors prior to making your moves.

My opinions here are just that, opinions! The fact that I’ve been in the residential real estate market for over three decades, does not mean that my opinions are going to be any more accurate then your mother-in-law’s opinion, though I sure hope they are!

Real Estate Home Sales COLLAPSE

#######

-

Brokerforyou.com is for SALE

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google, they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion! YouTube now operates as one of Google’s subsidiaries.

www.brokerforyou.com is for sale and is offered with a very popular San Diego residential real estate channel with 1.16K subscribers and 114 videos!!

What’s the approximately monthly cost to host a website? With shared hosting, you’re hosting fee can break down to about 10 to $15 per month. To keep your url registered (that’s your site address), this is usually paid on a five to 10-year basis, which averages out to about just a dollar per month! Naturally, if you add direct hook-up to a MLS database, that provides lead capturing, this costs can vary greatly from provider-to-provider.

Interested, call Bob Schwartz (619) 286-5604 for additional information

-

#######

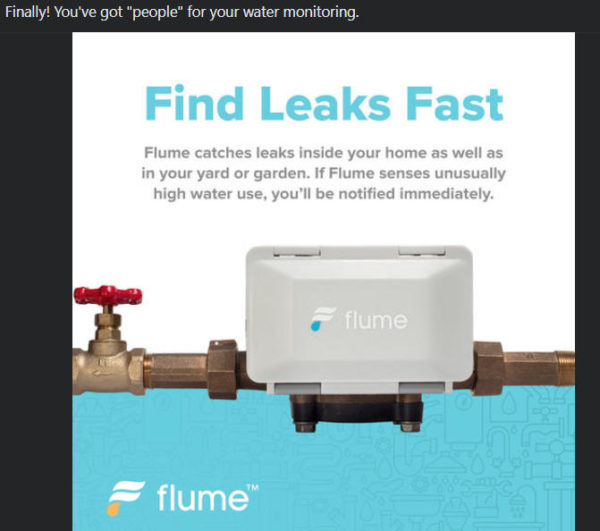

home water leak detector – https://flumewater.com?grsf=w79pta

+++++++++++++

Great DRONE Value

Comments are closed.