New Tax Hikes Bad for Real Estate Market

New Tax Hikes Bad for Real Estate Market and stock markets!

Massive Tax Hikes Across the Board – Could be just days away!

We may be facing massive tax increases in the coming days! What should you do to shield yourself against massive tax increases such as capital gains tax, income tax and other taxes that will be needed as congress raises capital for the new 3.5 Trillion Dollar Infrastructure Bill?

New Tax Hikes Bad for Real Estate Market

The wealthy are watching their income, their profits and more and shielding themselves from massive tax hikes. Are you worried about a big tax bill? What is your thought on increased taxes? Will this impact the stock market, real estate market and the economy as a whole?

Leave it to the left to come up with ideas that never pan out or work out. We’re already suffering from this disdainful administration’s purposeful harm, and even more harm coming down the pike. We just had terrible jobs report.

Job creation for August was a huge disappointment, with the economy adding just 235,000 positions, the Labor Department reported Friday. Economists surveyed by Dow Jones had been looking for 720,000 new hires. The unemployment rate dropped to 5.2% from 5.4%, in line with estimates. August’s total — the worst since January — comes with heightened fears of the pandemic and the impact that rising Covid cases could have on what has been a mostly robust recovery.

The weak report could cloud policy for the Federal Reserve, which is weighing whether to pull back on some of the massive stimulus it has been adding since the outbreak in early 2020. “The labor market recovery hit the brakes this month with a dramatic showdown in all industries,†said Daniel Zhao, senior economist at jobs site Glassdoor. “Ultimately, the Delta variant wave is a harsh reminder that the pandemic is still in the driver’s seat, and it controls our economic future.â€

Leisure and hospitality jobs, which had been the primary driver of overall gains at 350,000 per month for the past six months, stalled in August as the unemployment rate in the industry ticked higher to 9.1%. Instead, professional and business services led with 74,000 new positions. Other gainers included transportation and warehousing (53,000), private education (40,000) and manufacturing and other services, which each posted gains of 37,000. Retail lost 29,000, with the bulk coming from food and beverage stores, which saw a decrease of 23,000.

“The weaker employment activity is likely both a demand and supply story — companies paused hiring in the face of weaker demand and uncertainty about the future while workers withdrew due to health concerns,†Bank of America economist Joseph Song said in a note to clients. The report comes with the U.S. seeing about 150,000 new Covid cases a day, spurring worries that the recovery could stall heading into the final part of the year. “Delta is the story in this report,†said Marvin Loh, global macro strategist for State Street. “It’s going to be a bumpy recovery in the jobs market and one that pushes back against a more optimistic narrative.†The month saw an increase of about 400,000 in those who said they couldn’t work for pandemic-related reasons, pushing the total up to 5.6 million. “Today’s jobs report reflects a major pullback in employment growth likely due to the rising impact of the Delta variant of COVID-19 on the U.S. economy, though August is also a notoriously difficult month to survey accurately due to vacations,†said Tony Bedikian, head of global markets at Citizens.

Well, if the economy ain’t wrecked yet, this will do it. And don’t think it’s the old democrat lie, just on the rich. It’s gonna be on everyone who works, just like always. We still have a small chance Biden is already a failed president and a lame duck. Call your reps and senators and raise a beef with them. They don’t want to be tied to this loser.

New Tax Hikes Bad for Real Estate Market

San Diego Real Estate Website for sale

www.brokerforyou.com     *** This 23 year old San Diego real estate website is for sale! Also, aged real estate sites in many California cities are for sale.

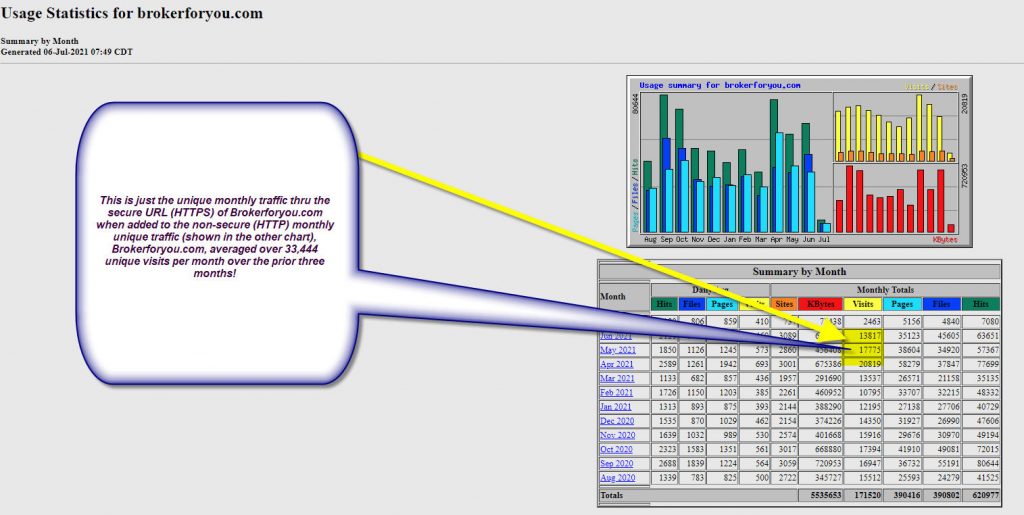

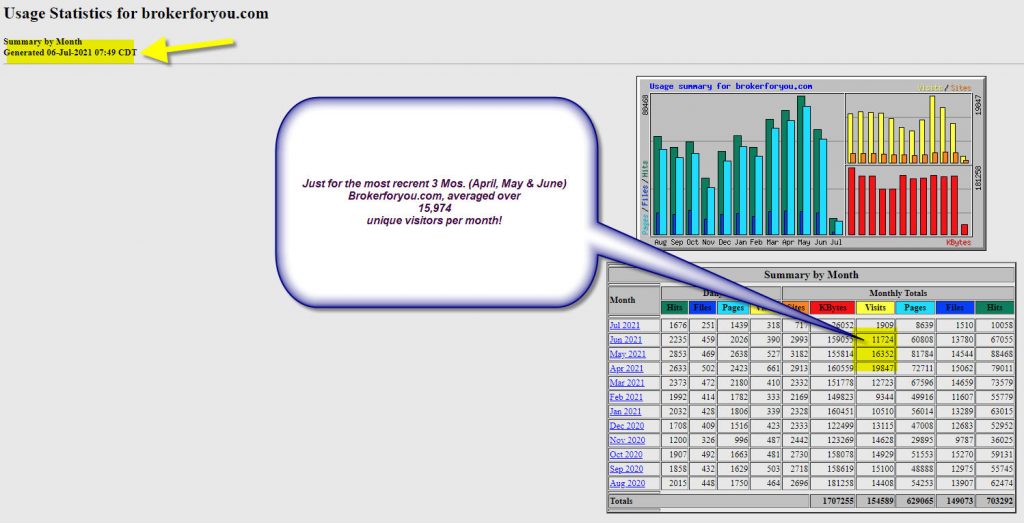

Over 33,444 average monthly unique visits to Brokerforyou.com in the last three months.

*NO you are NOT just getting a super San Diego URL, but, 23 years of great San Diego centered residential real estate content! Plus, great search engine rankings and most important, a HUGE amount of unique monthly visitors! If can’t see the very unique potential, perhaps you should save your time and NOT review the information below.

www.brokerforyou.com is 23 Years old! The vast majority of search engine professionals agree that the age of a website is an important factor in the Google algorithm.

There is also another undisputed factor in the ranking of websites. That factor, is the amount of unique specific content published on the website. So, it’s pretty hard for a two year old or a five-year-old or for that matter a 10-year-old website out rank a 23-year-old website that has 2 to 4 times the content.

San Diego real estate opportunity – www.brokerforyou.com is for sale! if your real estate broker in San Diego California or thinking of expanding your brokerage business into San Diego, purchasing www.brokerforyou.com to give you a huge boost in becoming a player in the residential San Diego real estate market.

Sure as a real estate professional in San Diego California, you most probably have a website. But take a look at it take a look at the traffic you’re generating from that website. From my own analysis the majority of San Diego real estate websites just generate a couple of hundred unique views per month. To even have a chance of gaining one new client you need tens of thousands of unique views.

Brokerforyou.com is for SALE

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google, they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion – YouTube now operates as one of Google‘s subsidiaries.

www.brokerforyou.com is for sale and is offered with a very popular San Diego residential real estate channel with 1.17K subscribers and 97 videos!!

Interested, call Bob Schwartz (619) 286-5604 for additional information

Comments are closed.