Housing Market Collapse

Housing Market Collapse

Informative video but I believe it’s way too optimistic on saying there’s just going to be a 20% real estate market drop.

When one considers how much the real estate market has gone up over the last two years, I believe we’re going to see somewhere between twenty to 40% drop in prices between now and the end of 2023.

Housing Market Collapse

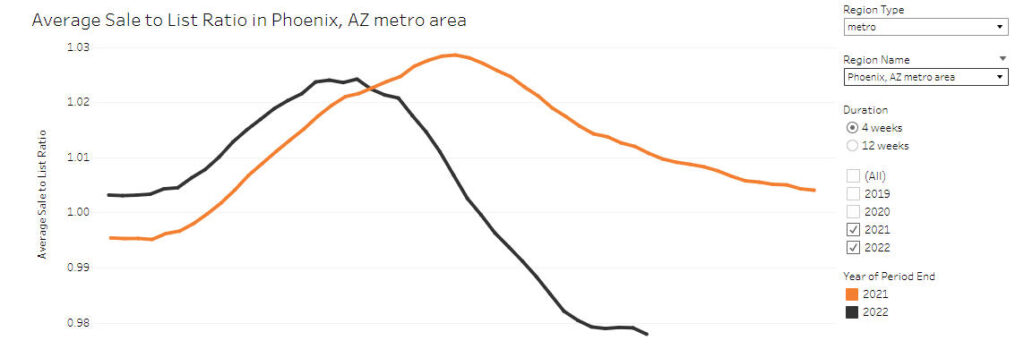

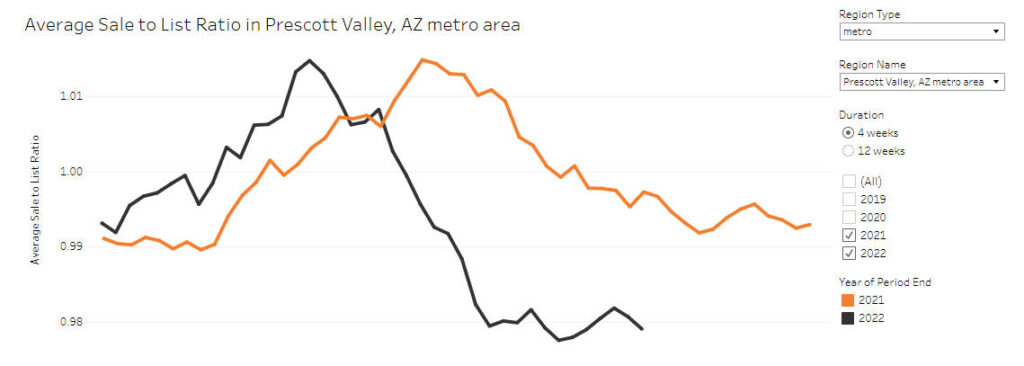

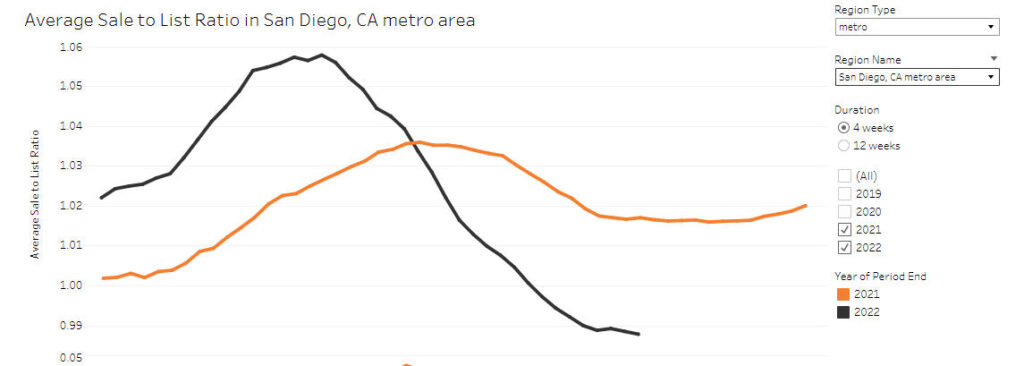

Home prices have just now starting to fall in the Metro areas that saw the largest price appreciation in the last two years.

When I first raised the red flags that I saw in the housing market many people who agreed with my opinion, did not believe it was going to be a major downturn. Yes, I got emails using terms like, slow down, pullback, softening and perhaps one of my favorites was a buying opportunity! In addition, a number of people felt that if there was going to be a turn in the housing market, it certainly was not going to approach what we saw in the last downturn around 2008.

Having been in the residential real estate market for over three decades, reactions like this from the general public are the norm. Now, I don’t really know the ages of the people who were sending me their comments about a mild real estate pullback, but I’d venture a guess, that they were way too young to own a home during the 2008 housing bust.

So, for all those who said our current housing market downturn is going to be nothing like the last downturn in real estate, I’d like to say, that I agree with you 100%! Yes, personally I think this Market downturn that has just started, is going to be much more severe then the downturn that occurred in 2008!

Currently the latest feedback I’m getting on my post, are along these lines: the moment interest rates turn down, the housing market will be back on its upward course.

Although this type of thinking in a general sense is correct, after any major market fall there has to be a stabilization period, that can actually take months or years, before the market starts to head up again. Keep in mind, with these current federal reserve aggressive rate hikes, not only is it breaking the back of the housing market, but also the general US economy.

Higher interest rates on credit card balances combined with higher gasoline and food cost, are really walloping the disposable income of the average worker. So, people are pulling back on expenditures wherever possible. This pullback in purchasing, has already, and will continue, to result in layoffs and increasing unemployed. So, even if interest rates do turn, if you don’t have a job, or meager, if any, cash reserves on hand, you’re certainly not going to be considering jumping back into the real estate market.

Here are some graphs I created today (from Redfin data) showing the average home sale price vs. the MLS listing price for Phoenix, Prescott Vly and San Diego:

++++++++++++++++++++++++++++++++++++++++++++++++

++++++++++++++++++++++++++++++++++++++++++++++++

Homeowners should understand, that just because you don’t have to sell at any time in the near future, you’re going to escape this downturn. Just like many didn’t sell their homes as prices escalated, yet their homes became worth more because of demand. In today’s market, the same is true, now lower sold prices turn into depreciation for existing homes.

Always keep in mind, that purchasing or selling a home is a major lifestyle decision, and as such, should not be rushed into. So, by all means, if you’re considering purchasing or selling real estate in today’s market, do your own homework and draw your own conclusions! But, also consult with your legal & financial advisors prior to making your moves.

My opinions here are just that, opinions! The fact that I’ve been in the residential real estate market for over three decades, does not mean that my opinions are going to be any more accurate then your mother-in-law’s opinion, though I sure hope they are!

Housing Market Collapse

#######

-

Brokerforyou.com is for SALE

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google, they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion! YouTube now operates as one of Google’s subsidiaries.

www.brokerforyou.com is for sale and is offered with a very popular San Diego residential real estate channel with 1.16K subscribers and 114 videos!!

What’s the approximately monthly cost to host a website? With shared hosting, you’re hosting fee can break down to about 10 to $15 per month. To keep your url registered (that’s your site address), this is usually paid on a five to 10-year basis, which averages out to about just a dollar per month! Naturally, if you add direct hook-up to a MLS database, that provides lead capturing, this costs can vary greatly from provider-to-provider.

Interested, call Bob Schwartz (619) 286-5604 for additional information

-

#######

home water leak detector – https://flumewater.com?grsf=w79pta

+++++++++++++

Great DRONE Value

Comments are closed.