Housing Market – Boom to Bust

Housing Market – Boom to Bust

The year 2022 will be remembered as a big turnaround for the real estate market. After two unbelievable years of housing appreciation, where in many hot markets across the country homes appreciated in the low-to-mid 20% range, this year saw a 180-degree reversal.

This turnaround was surprising for the majority but for insiders who tracked these trends, it was inevitable.

Housing Market – Boom to Bust

For two years the housing market was in a buying frenzy. I don’t mean it was a hot market, it was a mania! Whether it be the housing market or the stock market, when a mania sets in, it’s just a matter of time before there’s a sharp reversal and people and markets come to their senses.

All markets are driven by mass psychology. When you have the Inevitable sharp reversal, the first general reaction is denial. In real estate this usually takes form by denying the facts pointing to the reversal and stating that even if it is happening to some degree, it is not happening in our local market.

This is usually followed by blaming the messenger. Whether that messenger be a local Realtor or national financial reporter, they must have their data wrong or are exaggerating. At this point the old rationale of there’s a housing shortage is trotted out as an explanation why a slowdown is only temporary; a great pause allows the gullible naïve buyer an opportunity to jump into the market before things ‘take off’ again.

As the market continues to slide, and now because of the duration and extent of the downward correction, it can no longer be denied. The second stage sets in.

The second stage is marked by anger. In the real estate market this anger is at finally realizing that the real estate market insiders are just salespeople. They are always over optimistically representing an ever-escalating housing market.

The third stage of a housing market decline is exhibited with people who have to sell during the downturn, for various reasons. This stage is marked by bargaining. Bargaining not only with the sales price but with adding various incentives that may be necessary to generate decent offers.

Now for the fourth stage in a real estate market decline. This fourth stage is where I personally believe we are right now. This stage is marked by acquiescence of the decline in progress. Although no longer denying the trend, during this stage many will bring up examples why they believe it will be mild or approaching a bottom. Also, at this junction you usually hear multiple reasons why today’s market is different from the last major downturn. Although thinking like this might be correct when you’re coming off of a traditional hot market; it is incorrect when coming off of an Irrational exuberant housing market!

This market decline is different from the last major housing decline, which was ignited by many easy-lending policies of the mortgage industry.

What the general public fails to realize today, is that a large portion of the astronomical housing appreciation we’ve experienced, is attributable to major organizations of real estate investors buying homes. The investor’s intent was a quick flip, or short-term high-yield rentals to offset the carrying cost, for a year or two until the property can be placed back on the resale market.

In the last downturn, we didn’t see this type of investor group buying on the scale for the last couple of years.

The problem with this large amount of investor-owned homes is as the market goes down, these investors see their profit potential shrink. In many cases profits totally disappear. Unlike homeowners, investors want to cut their losses immediately and are not hesitant about putting their homes back on the market for a quick sale.

We’ve already seen some major real estate buying organizations pull out of this market because they saw the red flags earlier in the year. However, there is still a tremendous amount of housing inventory owned by these investment groups.

As the market continues downward, it just a matter of time before these huge pools of investor-owned homes hit the resale market. Unfortunately, when this happens, it’s just going to accelerate the downward housing trend.

At this time of year, I wish I could provide you with better news. It’s my opinion that the bottom to this housing market is not yet in sight. With that said, if I was considering getting back into the housing market, I might start looking toward the end of 2023.

Housing Market – Boom to Bust

#######

-

Brokerforyou.com is for SALE

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google, they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion! YouTube now operates as one of Google’s subsidiaries.

www.brokerforyou.com is for sale and is offered with a very popular San Diego residential real estate channel with 1.16K subscribers and 114 videos!!

What’s the approximately monthly cost to host a website? With shared hosting, you’re hosting fee can break down to about 10 to $15 per month. To keep your url registered (that’s your site address), this is usually paid on a five to 10-year basis, which averages out to about just a dollar per month! Naturally, if you add direct hook-up to a MLS database, that provides lead capturing, this costs can vary greatly from provider-to-provider.

Interested, call Bob Schwartz (619) 286-5604 for additional information

-

#######

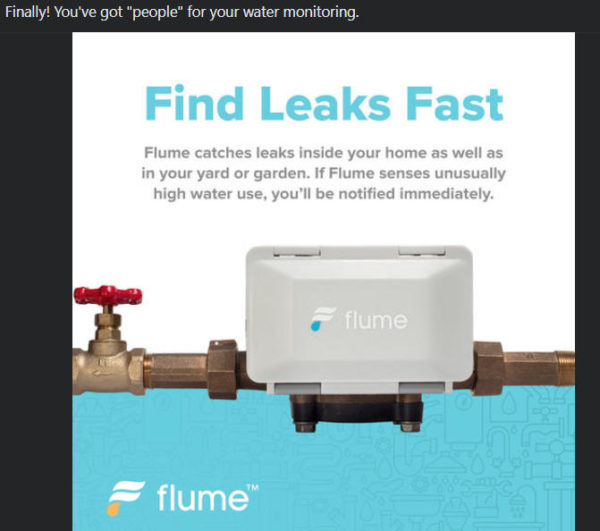

home water leak detector – https://flumewater.com?grsf=w79pta

+++++++++++++

Great DRONE Value

-

DISCLAIMER:

Some of the links in this description and in our videos may be affiliate links, and pay a small commission if you use them. I really appreciate the support.

The content in my Youtube videos SHALL NOT be construed as tax, legal, insurance, construction, engineering, health & safety, electrical, financial advice, or other & may be outdated or inaccurate; it is your responsibility to verify all information. I am a not financial adviser. I only express my opinions based on my experiences. Your experience may be quite different. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. You must conduct your own research. There is NO guarantee of gains or losses on any investments.

My produced videos are for entertainment purposes ONLY. DO NOT make buying or selling decisions based on these videos. If you need advice, please contact a qualified CPA, attorney, insurance agent, contractor/electrician/engineer/etc., financial advisor, or the appropriate professional for the subject you would like help with. Linked items may create a small financial benefit for me.

Comments are closed.