Home Mortgage Crisis Is Getting Worse

Home Mortgage Crisis Is Getting Worse

In this video Peter Schiff warns about the dangerous trends in mortgage and refinance applications that may lead to something bigger down the road…

Peter D. Schiff is an economist, stock broker, financial specialist, host of the Peter Schiff Show Podcast, and author. He is the CEO and chief global strategist of Euro Pacific Capital Inc. Mr. Schiff has also written a number of books on investing over the years. He educates people all over the world about free market economics and the principles and benefits of individual liberty, limited government and sound money.

Home Mortgage Crisis Is Getting Worse

What’s next you ask, massive inventory surplus due to lower cash in people’s pocket, then the layoffs, then the recession, then GET READY( DEPRESSION).run for cover! Put people that had economic business success in office, elect people with brains!

Fed Rate Hikes will cause the 2022 Market Crash to get even worse. Investors should make preparations for 50% Declines.

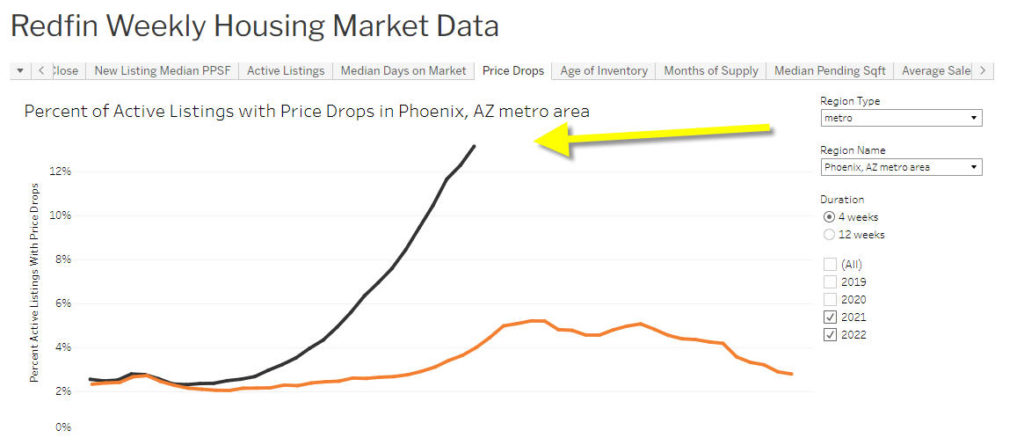

40-Year High Inflation is causing the Federal Reserve to aggressively raise interest rates. These Rate Hikes are now causing Treasury Yields to surge. Which is becoming a BIG PROBLEM for Investors – particularly Real Estate Investors. The

6 Month US Treasury now yields 3.7%. That’s the highest level in 15 Years and is now nearly as high as the Real Estate Cap Rate (4.5%). This low cap rate premium means that Investors, particularly Wall Street Investors, will stop buying Houses. And will start looking to sell.

Some Wall Street Investors might even get a Margin Call by their bank over the next year as the cost debt to own real estate surges due to Jerome Powell’s Rate Hikes. The result will be that Home Prices in America continue to go down as Investor Demand in the Housing Market tanks.

Surging Interest Rates and Treasury Yields will also likely result in a Recession. That’s because every time the Fed aggressively hikes interest rates over the last 70 Years, a Recession in the economy follows.

Homeowners should understand, that just because you don’t have to sell at any time in the near future, you’re going to escape this downturn. Just like many didn’t sell their homes as prices escalated, yet their homes became worth more because of demand. In today’s market, the same is true, now lower sold prices turn into depreciation for existing homes.

Always keep in mind, that purchasing or selling a home is a major lifestyle decision, and as such, should not be rushed into. So, by all means, if you’re considering purchasing or selling real estate in today’s market, do your own homework and draw your own conclusions! But, also consult with your legal & financial advisors prior to making your moves.

My opinions here are just that, opinions! The fact that I’ve been in the residential real estate market for over three decades, does not mean that my opinions are going to be any more accurate then your mother-in-law’s opinion, though I sure hope they are!

#######

-

Brokerforyou.com is for SALE

Just like most major businesses, the easiest way, and the fastest way to expand your business and influence in your particular market is through strategic acquisition. Just look at Google, they are the number one search engine in the world! Google bought Youtube in November 2006 for US$1.65 billion! YouTube now operates as one of Google’s subsidiaries.

www.brokerforyou.com is for sale and is offered with a very popular San Diego residential real estate channel with 1.16K subscribers and 114 videos!!

What’s the approximately monthly cost to host a website? With shared hosting, you’re hosting fee can break down to about 10 to $15 per month. To keep your url registered (that’s your site address), this is usually paid on a five to 10-year basis, which averages out to about just a dollar per month! Naturally, if you add direct hook-up to a MLS database, that provides lead capturing, this costs can vary greatly from provider-to-provider.

Interested, call Bob Schwartz (619) 286-5604 for additional information

-

#######

home water leak detector – https://flumewater.com?grsf=w79pta

+++++++++++++

Great DRONE Value

Comments are closed.