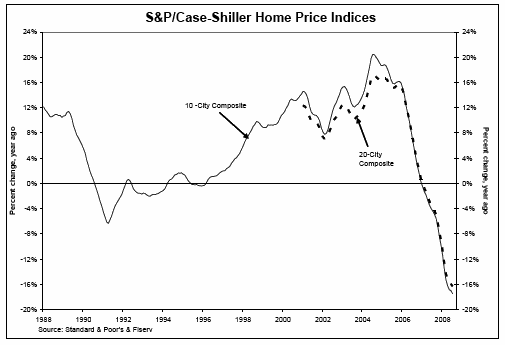

Real Estate Record Home Price Declines

The latest S&P/Case-Shiller Home Price Indices were just released.

The 10-City and 20-City indices reached new record annual declines of 17.5% and 16.3%, respectively. The 10-City level marked its 10th consecutive monthly report of a record decline, beginning with data reported for October 2007.

While the annual returns of the two indices continue to reach record lows, the pace of the decline has slowed, particularly over the last three months.

For the three months of May through July, home prices cumulatively fell about 2.2%,whereas for the three months of February through April, and November 2007 through January, the cumulative rates of decline were closer to 6.0-6.5%.

A few prior posts on home value declines:

San Diego Real Estate – 5th Largest Decline Through July

Yale Professor … House Price Decline Could Be Worse than Great Depression

Survey Says Home Values Must Fall Another 14%

Summary of the “Housing and Economic Recovery Act of 2008

Billionaire warns global boom is over

Trackbacks & Pingbacks

Comments are closed.

“We’re nearing a plateau” – this is wishful and dangerous thinking. We’re not even halfway through the subprime resets, and starting next year a wave of even more toxic Option ARMS will start resetting. Home prices will be falling for the next 10 years. Buy a home to ENJOY if you must, but don’t look at it as a get rich quick investment.

Eye Specialist

There’s an extremely simple way to avoid foreclosure: make your mortgage payments on time every month. If you are unwilling or unable to do so, then you will lose your house. This is exactly what you agreed to in the mortgage contract that you signed. Expecting the rest of us to “bail you out” is a morally indefensible position.

Medical Researcher

Now I realize Greenspan probably kept interest rates too low after the dot.com bubble and 9/11 and Congress may have been too aggressive in requiring banks to lend to ‘sub primers’ and Bush may have gone overboard with his ‘ownership society’ schemes but at the end of the day it was the American people that did this. No one was frogged marched down to a mortgage brokers office and water boarded until they signed a loan to buy a house they could not afford. People did it to themselves. I was tempted too I admit and even looked at houses. Met an agent who had drawn up an offer. Looked it over and said ‘lemme think it over’. Called him back the next day and said ‘nope, don’t need a new house.

San Diego Bail Provider

Why always blame somebody else? What happened to self responsibility and self accountability? If you cannot afford the house payments then don’t buy a house. If you cannot qualify for a fixed-rate 30-year loan, then that means you are not qualified! It’s your responsibility to know how much you can afford. It’s as simple as that.

Skin Doctor

This is all Obama’s and his leftist friends from Chicago fault. Individuals are walking away and not taking responsibility for their financial commitments. They know Obama and Co. won’t do anything. It’s his fault. I can’t wait for him to be defeated in November.

San Diego Attractions