San Diego homes for sale

San Diego homes for sale

In San Diego, California, there is a wide range of homes for sale. There are luxury homes in downtown San Diego for sale in high-rise buildings, there are San Diego homes for sale with ocean views, and there are San Diego homes for sale in the East County that have mountain and city light views.

httpv://youtu.be/jn2ucEKEzg0

Read more

San Diego Home Prices – Are We At A Bottom?

Home prices should come back to 2001 level, then we can say that the San Diego real estate market has finished it's correction.

Home prices should come back to 2001 level, then we can say that the San Diego real estate market has finished it's correction.

For now, I think the San Diego real estate market is in for a very slow recovery due to unemployment that looks like it may skyrocket. This recession is just now starting. This will further accelerate pressure on the housing sector but also later on, push interest rates higher in order for banks to recoup losses. No one has even started talking about the other wave of credit mess, Credit Card debt and the huge amount of adjustable loans issued in 2004-2005 that are set for their first adjustment in 2009. san diego real estate news

Recent Related Posts:

Stock Market Rally … A Real Bottom?

San Diego Real Estate …The Coming Up-tick

California Gives New Home Buyers $100 Million

San Diego Real Estate – No Relief From Obama

San Diego troubled homeowners will not see a great deal of assistance from the Obama housing bailout according to the available details at this time. Things may change, of course, by the scheduled March 4th release of the full details on this plan. As it stands now, here are the main reasons this plan will not help many San Diego homeowners:

San Diego troubled homeowners will not see a great deal of assistance from the Obama housing bailout according to the available details at this time. Things may change, of course, by the scheduled March 4th release of the full details on this plan. As it stands now, here are the main reasons this plan will not help many San Diego homeowners:

A. The maximum difference in the mortgage amount and the home's vale is 5%. The average loss in San Diego home values just last year was well into double digits. Even with an original down payment of 20%, one’s mortgage could easily be much greater than the 5% cap.

B. The maximum original loan could not exceed $417,000. While a $417,000 mortgage loan can only be for a luxury home in most parts of the United States, which would not necessarily the case in San Diego.

C. The assistance only applies when one loan was originated. Many San Diego homeowners purchased with a combination of a first and second loans.

D. Option ARM loans are not included.

E. If you have a second (or equity) loan on your property, you are not included.

Every single person who enters into a mortgage should be responsible enough to consider the down side and be honest about their long-range job prospects.

I was calling it a housing bubble in 2003 and research shows that was not a bizarre or un-shared opinion. The idea that the bust was a big surprise is just a modern fable used by people who don't want to take responsibility for their financial misdeeds. The nanny-state solution we are now stuck with is the worst possible approach.

I take comfort from two things:

1) It is a government administered program and will most likely fail to perform. The fact is that the government has a history of messing stuff like this up. It seems likely that the program will be bogged down by bureaucracy and ineptitude. I will not be surprised by news stories about people still losing their homes because they are unable to navigate through the maze of requirements and regulations.

2) It is not as bad as it could have been. Since absolute power corrupts absolutely we could have seen much worse. Much as I dislike the administration’s politics, I find some comfort that the program is limited to primary residences.

Overall, this program is a severe blow to the good people who did the right thing. The government is robbing us to buy votes from the those dishonest individuals who saw a way to game the system, and did it, knowing full well that they were taking unconscionable risks. San Diego Realtor

Recent Related Posts:

New Tax Credit for First-Time Homebuyers

Obama’s Mortgage Bailout – Many Disagree!

Obama’s $275 Billion Housing Recovery Plan

San Diego Negative Home Equity

San Diego real estate mortgage bust. Much has been made of stated income, nina, ninja, etc. loans. The fact remains that the debt to income levels that were accepted during the boom time for people who could document their income exceeded 55%. Sub prime borrowers who could document their income could have DTI levels from 50-55%.

San Diego real estate mortgage bust. Much has been made of stated income, nina, ninja, etc. loans. The fact remains that the debt to income levels that were accepted during the boom time for people who could document their income exceeded 55%. Sub prime borrowers who could document their income could have DTI levels from 50-55%.

What is not talked about is that Fannie and Freddie loans could get approved with DTI levels as high as 63%. Typically a borrower would need some other strong factor such as high FICO or 6-8 months in reserve. Nevertheless, people are not walking from their homes just because they are upside down. Like most things in life there is rarely one answer, rather a multitude of factors.

Get ready for the next wave of foreclosures, just months away. This new wave of foreclosures will be prime mortgages on upper end homes. San Diego real estate agent

San Diego Real Estate – Recovery or Collapse?

The Doom & Gloom scenarios seem almost universal – indicating that perhaps the worst has already been discounted. Don't expect any 'instant' clearly defined bottom. It's going to take months, many months, before a real bottom is established.

The Doom & Gloom scenarios seem almost universal – indicating that perhaps the worst has already been discounted. Don't expect any 'instant' clearly defined bottom. It's going to take months, many months, before a real bottom is established.San Diego Real Estate – 5th Largest Decline Through July

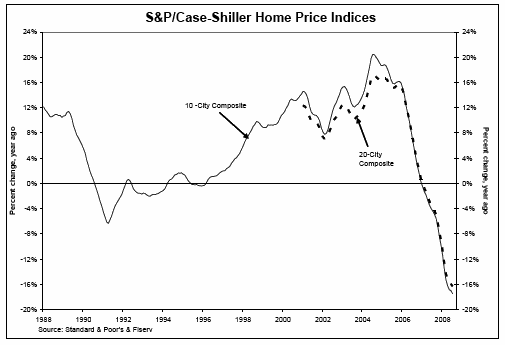

San Diego California home values showed the 5th largest decline for the latest July 2007 to July 2008 S&P/Case-Shiller Home Price Indices.

“There are signs of a slow down in the rate of decline across the metro areas, but no evidence of abottom” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “Little positivenews can be found when cities like Las Vegas and Phoenix report annual declines as large as -29.9% and

-29.3%, respectively, and all 20 cities are still in negative territory on a year-over-year basis. The Sunbelt

continues to be the story, with the seven cities that basically represent that area reporting annual declines

roughly between 20 and 30%. While some cities did show some marginal improvement over last month’s

data, there is still very little evidence of any particular region experiencing an absolute turnaround.”

The table below summarizes the results for July 2008. The S&P/Case-Shiller Home Price Indices are revised for the 24 prior months, based on the receipt of additional source data.

The Steady Rise in San Diego Unemployment

San Diego’s unemployment rate continues to be lower than California and the United States as a whole. The bad news is that it’s been on the rise since March. According to the San Diego Workforce Partnership, in March, San Diego’s unemployment was at 4%, the lowest all year, compared to 5.1% in California and 4.5% in the United States. By July, San Diego’s unemployment stood at 4.8%, while California was at 5.5% and the United States was at 4.9%. National City has been hit the hardest. Most recently the city’s unemployment rate was 9.6%. Imperial Beach’s unemployment rate was at 7.9% and the lowest rates around San Diego County were Valley Center (2.2%), Del Mar (2.3%), and Poway (2.8%). San Diego CA real estate

15 Year Low For Boston Home Values!

Single-family house sales in Boston dipped to a 15-year low by 8.4 percent, indicating how the real estate slump has negatively affected various U.S. states. Only 50,435 new single-family homes were sold in 2007, down from 2006's 55,054, according to a report by The Warren Group, publisher of real estate information in Boston. San Diego California real estate agents