California Real Estate Crash?

California Real Estate Crash

The hardest thing to ever predict is “When” will the markets crash. In this video, I will show you what new things are developing in the real estate and mortgage markets and we will try and take a guess to predict the timing of the next real estate housing correction.

Here are 3 major factors that discuss in depth in the video:

1. Debt Loads U.S. households are cracking under the weight of the debt they’re carrying. Household debt has risen for 23 straight quarters – and as of April, it stands at $14.3 trillion, according to the Federal Reserve Bank of New York. Auto debt’s been rising steadily for 36 months and now totals $1.35 trillion. Student loan debt exceeds $1.42 trillion. Credit card debt totaling more than $1.079 trillion just saw delinquencies rise 9.09% in April – to their highest level in two years. Read more

San Diego Home Prices – Are We At A Bottom?

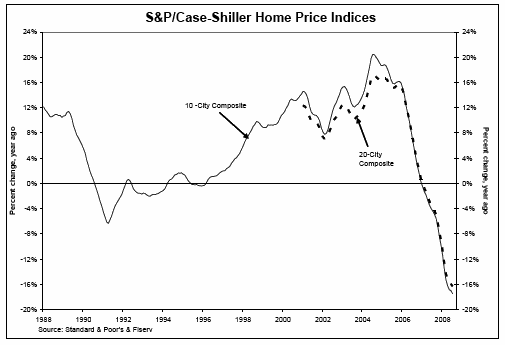

Home prices should come back to 2001 level, then we can say that the San Diego real estate market has finished it's correction.

Home prices should come back to 2001 level, then we can say that the San Diego real estate market has finished it's correction.

For now, I think the San Diego real estate market is in for a very slow recovery due to unemployment that looks like it may skyrocket. This recession is just now starting. This will further accelerate pressure on the housing sector but also later on, push interest rates higher in order for banks to recoup losses. No one has even started talking about the other wave of credit mess, Credit Card debt and the huge amount of adjustable loans issued in 2004-2005 that are set for their first adjustment in 2009. san diego real estate news

Recent Related Posts:

Stock Market Rally … A Real Bottom?

San Diego Real Estate …The Coming Up-tick

California Gives New Home Buyers $100 Million

San Diego Negative Home Equity

San Diego real estate mortgage bust. Much has been made of stated income, nina, ninja, etc. loans. The fact remains that the debt to income levels that were accepted during the boom time for people who could document their income exceeded 55%. Sub prime borrowers who could document their income could have DTI levels from 50-55%.

San Diego real estate mortgage bust. Much has been made of stated income, nina, ninja, etc. loans. The fact remains that the debt to income levels that were accepted during the boom time for people who could document their income exceeded 55%. Sub prime borrowers who could document their income could have DTI levels from 50-55%.

What is not talked about is that Fannie and Freddie loans could get approved with DTI levels as high as 63%. Typically a borrower would need some other strong factor such as high FICO or 6-8 months in reserve. Nevertheless, people are not walking from their homes just because they are upside down. Like most things in life there is rarely one answer, rather a multitude of factors.

Get ready for the next wave of foreclosures, just months away. This new wave of foreclosures will be prime mortgages on upper end homes. San Diego real estate agent

San Diego Homeowners with Underwater Loans

People might have got into these loans without thinking too hard but I guarantee you that they won't leave as foolishly. You don't need to be Robert Shiller to understand that your housing equity is not coming back any time soon and that rents are becoming ever more affordable.

People might have got into these loans without thinking too hard but I guarantee you that they won't leave as foolishly. You don't need to be Robert Shiller to understand that your housing equity is not coming back any time soon and that rents are becoming ever more affordable.

Besides… who needs a credit score in the next 4 years anyway? Many people approaching 800 on their FICO are still being denied new credit card offers and have no desire to purchase any real estate until the dust settles.

Many strongly believe that underwater homeowners should walk away en masse unless their true desire is to stay put for the next 15 to 20 years. Rip the band-aid off!!! San Diego Realtor

Real Esate Outlook 2009 … Economist Gary Shilling

The San Diego real estate market turn-around in 2009 seems to be the usual New Year rose-colored glasses media 'talking head' consensus.

The already crumbling housing market could plummet an additional 20%, says Gary Shilling, president of A. Gary Shilling & Co.

San Diego housing is already down over 30%, but according to Shilling, there's no near-term bottom in sight.

Excess inventory – nearly a year's worth supply – is the "mortal enemy" of any recovery in housing, says Shilling, who does not believe the Fed's efforts to lower mortgage rates will resolve the crisis.

[youtube]LnN1VQnikow[/youtube]

San Diego real estate – 2009 the Option ARM resets

Many local mortgage lenders feel that San Diego & Southern California were the prime locations for the adjustable Option ARM loans. Now, just when many believed the mortgage crisis was winding down, San Diego real estate will be facing another major obsticle.

Our first post on this problem was San Diego Real Estate … The Coming Next Wave of Foreclosures, published on 7-17-08. It took a little while, but now the major media outlets have picked up on this problem. San Diego Realtors

[youtube]9ZtNzcWTck8[/youtube]

San Diego Real Estate – It Could Get Really Ugly

Did you see Fortune magazine's article (12/22/08) regarding their picks for the worst 10 real estate markets in the nation for 2009? Eight of the 10 worst markets they've called are here in California. Fortune's article projected valuation losses in the eight California cities of 21-25% for 2009 and additional 2-5% losses for 2010. Really, not what you want to hear anytime, but especially at new years.

Did you see Fortune magazine's article (12/22/08) regarding their picks for the worst 10 real estate markets in the nation for 2009? Eight of the 10 worst markets they've called are here in California. Fortune's article projected valuation losses in the eight California cities of 21-25% for 2009 and additional 2-5% losses for 2010. Really, not what you want to hear anytime, but especially at new years.

Related other blogger's posts:

- San Diego Real Estate Bubble Caused Local Recession : The Real …

- Housing Analysis: Real Estate Prices fall again in December 2008

- The Housing Chronicles Blog: Investors returning to California's …

- The Housing Bubble Blog » Bits Bucket For January 6, 2009

- San Diego real estate blog » San Diego Real Estate Bust of 1945?

- Bubble Markets Inventory Tracking: More On the Purchase

– San_diego San Diego’s local economy was largely real estate driven in the early part of the century. The real estate bubble fueled an economy that fed real estate agents, mortgage brokers, and construction workers, and fed off itself. …

– VANCOUVER, B.C. – January 5, 2009 – The record-breaking real estate market cycle in Greater Vancouver, longer than normal at seven consecutive years, ended in 2008 amidst global economic challenges. The change brought relief from rising …

– A blog from a real estate industry writer, public speaker, and consultant with MetroIntelligence Real Estate Advisors, a division of Beacon Economics; providing commentary and news citations on regional, national and international real …

– Motivated sales, which include foreclosure auctions and banks selling homes taken over for non-payment, increased 193 percent from January to October 2008 from a year earlier, New York-based real estate data company Radar Logic Inc. …

– San Diego Real Estate Bust of 1945? by bob711 — published on December 10th, 2008. This is a must watch video, with a lot of solid points. This real estate bust is NOT fair! Already the California legislature is considering a four month …

– Number 2, it is typically still ok to buy at the peak of a "normal real estate cycle." Recall a few years back during the bubble peak a lot of folks were using the prior cycle and said, "well, we bought at the peak then and we did ok. …

San Diego Real Estate Appreciation Up 100%+

- Paper Economy – A US Real Estate Bubble Blog: Bernanke’s Nightmare …

- No. 1: Real estate bust sent ripples, washing away local sales …

- Top 5: Fraud, foreclosures and empty offices – Front Porch …

- REIT Wrecks: Commercial Real Estate Loans, Jamcrackers, Pike Poles …

- Paul Kedrosky: David Lereah Falls on His Real Estate Key Lockbox

– A Blog dedicated to tracking the demise of the greatest asset bubble in US history. Housing Bubble, Real Estate Bubble, Boston, San Diego, Miami Real Estate housing bubble,alan greenspan,housing boom,housing crash,bust,plunge,collapse …

– It s what you haven t heard or seen much of this year that defines what the economy has meant for the Wilmington area. The sounds of nail guns and drills and the whack of hammers have all but disappeared in many parts.

– But similar to one-time boomtowns like Las Vegas and Sacramento, the presence of so many real estate flippers looking for a hefty profit worsened the real estate bust when it finally came. "It's the nicest subdivision in Chiloquin," …

– Anthracite CDOs on Watch For Possible Downgrade (3.96%); 4. No Bottom In Commercial Real Estate Until 2010-20011 (3.44%); 5. The Coming Commercial Real Estate Bust: Why Developers Are Desperate For the Dole (3.39%) …

– Whoa, guess what: Former National Association of Realtors chief economist David Lereah didn't entirely believe what he was saying about the wonders of the pre-bust U.S. real estate industry. It was, as he says, his job to put a positive …

San Diego Home Values Drop Over 30%

MDA DataQuick just reported median price of all homes sold fell nearly 6 percent from October to November, dipping to a 6-1/2 year low to $305,000. Since November 2007, the median price of all homes sold was off more than 30 percent. Plus, the median price was off more than 41 percent from the market peak of $517,000 in November 2005.

MDA DataQuick just reported median price of all homes sold fell nearly 6 percent from October to November, dipping to a 6-1/2 year low to $305,000. Since November 2007, the median price of all homes sold was off more than 30 percent. Plus, the median price was off more than 41 percent from the market peak of $517,000 in November 2005.San Diego Real Estate Bust of 1945?

This is a must watch video, with a lot of solid points.

This real estate bust is NOT fair! Already the California legislature is considering a four month moratorium on foreclosures. In July, a new California law requiring lenders to try a number of times to contact homeowners prior to filing a notice of default has delayed the foreclosure process by 30 days. Plus, Obama is said to be in favor of a 90 nationwide foreclosure moratorium. With the average mortgage payments in San Diego running about $2,000 a month, who is paying for these moratoriums? Just one guess! To help, consider that the Government owns or will be buying these bad loans.

[youtube]Gw4SuFvIYPg[/youtube]

Why not just cut to the chase, and give the poor, misguided, troubled homeowners the homes for free? After all, the Constitution guarantees happiness, which in these days can be construed only to mean a big house, new cars, and lots of cash for lavish vacations. The poor want nice stuff as much as the rich, and they should have it. The rich guys shouldn't be the only ones who have convertibles and summer homes. Everyone should have those things.

Why should troubled homeowners have to leave their homes and go back to renting? Why wasn't the government watching out for them? It is just because no one watched out for them that they are now in trouble. If the bank was willing to loan all that money, why should the borrower bear any responsibility? Why are only a few people allowed to have what everyone wants? It isn't fair that only those with money are allowed to have a nice life when everyone wants to have a big house and new cars.

San Diego troubled homeowners should hang on; the Obama administration will turn this mess around. It looks like a 90 day nationwide foreclosure moratorium is assured. That should be followed about 60 days later, with another 90 day moratorium extension. Plus, if this plays out right, California should have its 120 day moratorium in effect by then. To be fair, I would assume the California moratorium will be in addition to the Federal moratorium. Those projected foreclosure moratoriums will run to about November 2009. Naturally, the government would not want to spoil the holiday period, so, somehow the foreclosures will again be postponed until 2010!

I’m just kidding with the above scenarios. We all know the San Diego real estate market is really on the verge of an historic ‘V’ shaped market bottom. In San Diego, by mid-2009, most real estate values will be appreciating by double digits! It certainly feels good to go into a fantasy world when talking about the San Diego real estate bust!

Related San Diego real estate bust posts:

Home Mortgages – One in Ten Behind in Payments

Will The Government Bailouts Really Help?

Greenspan … Wrong On Regulation

#1 EZ Fix to The U.S. Housing Market

Emergency Rescue Package – The Devil’s in The Details