Brokerforyou.com is for SALE

San Diego Residential Real Estate

brokerforyou.com for sale

www.brokerforyou.com is 20 Years old! The vast majority of search engine professionals agree that the age of a website is an important factor in the Google algorithm.

There is also another undisputed factor in the ranking of websites. That factor, is the amount of unique specific content published on the website. So, it’s pretty hard for a two year old or a five-year-old or for that matter a 10-year-old website out rank a 20-year-old website that has 2 to 4 times the content.

San Diego real estate opportunity – www.brokerforyou.com is for sale! if your real estate broker in San Diego California or thinking of expanding your brokerage business into San Diego, purchasing www.brokerforyou.com to give you a huge boost in becoming a player in the residential San Diego real estate market.

Sure as a real estate professional in San Diego California, you most probably have a website. But take a look at it take a look at the traffic you’re generating from that website. From my own analysis the majority of San Diego real estate websites just generate a couple of hundred unique views per month. To even have a chance of gaining one new client you need tens of thousands of unique views. Read more

San Diego Real Estate Traffic

San Diego Real Estate Traffic

The real secret in marketing (website marketing) is driving unique targeted traffic to your website.

Sure, you can have a great looking website with terrific graphics, color-coordinated, a motion background and decent content. But, unless your content generates a huge amount of targeted traffic, your not achieving the true potential that the Internet offers.

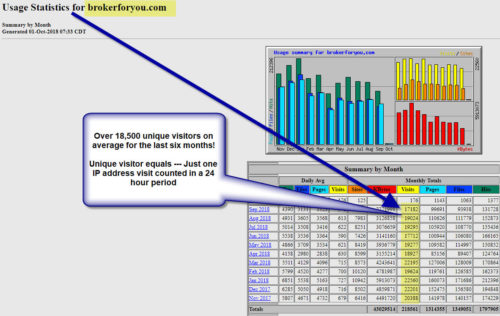

The best gauge for any websites authority and marketing potential is its unique monthly visitors! Keep in mind the unique visit is counted as just one visit from a URL, whether it’s a website or mobile device, in a 24 hour period.

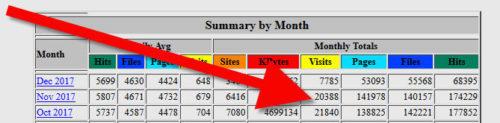

In November 2017, www.brokerforyou.com had over 20,300 unique visitors! Keep in mind, that in large metropolitan areas where real estate is very competitive, it takes hundreds of thousands of unique visitors to a real estate website to convert one, into a legitimate real estate buyer or seller!

San Diego real estate website traffic comparison:

Brokerforyou.com Visitors

Brokerforyou.com Visitors

Over 26,000 average unique visitors per month to this San Diego real estate blog site!

I’d like to say thank you to all my visitors.. It’s great to know that there such an interest in the real estate articles and opinions I post here on this San Diego real estate blog site.

I’d like to say thank you to all my visitors.. It’s great to know that there such an interest in the real estate articles and opinions I post here on this San Diego real estate blog site.

There’s a big difference between unique visitors and just hits to a website. The reason I tried to show how many unique visitors the site generates is because this figure is a much more accurate representation of the popularity of any site. Basically, a unique visitor is one visit from a specific URL in a 24-hour period. So, if this is the first time you’re visiting this site, the background software has counted your visit as a unique visit. And, if you go back to this site at any time within a 24-hour period from your first visit, the site will not count any other visits from your URL until a 24-hour period has elapsed from your initial visit. Read more

San Diego Real Estate Blog

San Diego Real Estate Blog

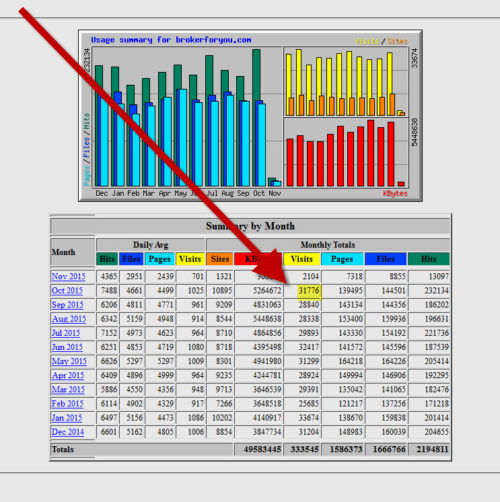

Our unique visitors for October 2015.

The above chart shows that for October this site www.brokerforyou.com had 31,776 unique visitors!

The above chart shows that for October this site www.brokerforyou.com had 31,776 unique visitors!

This huge targeted San Diego real estate traffic is what differentiates this site from the vast majority of other local San Diego real estate websites! This type of traffic gives a tremendous boost to anyone of my listings that are always posted here not only with photos but also with a video, because they are exposed to this kind of interested San Diego real estate visitor! Read more

San Diego Real Estate Blog Traffic

San Diego Real Estate Blog Traffic

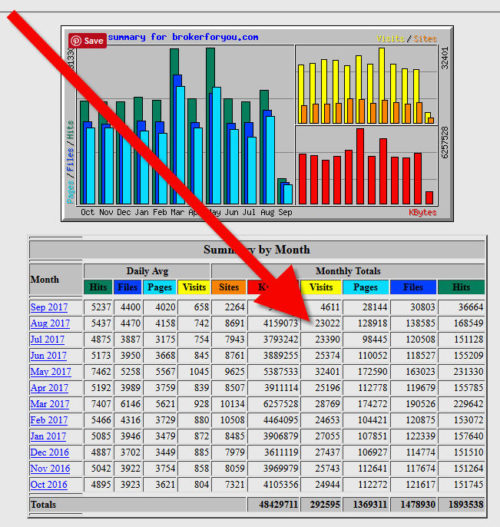

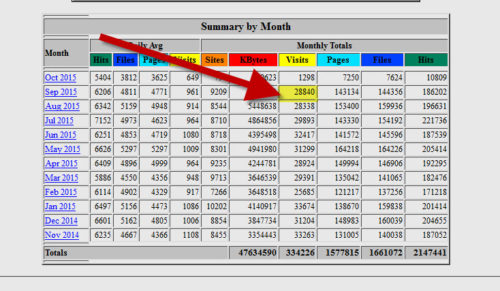

Our unique visitor traffic last month was over 28,800!

When you’re selling your San Diego home the key to success (selling within your predetermined time-frame at the best possible price) is a well-thought-out and successfully implemented professional real estate marketing program. Read more

When you’re selling your San Diego home the key to success (selling within your predetermined time-frame at the best possible price) is a well-thought-out and successfully implemented professional real estate marketing program. Read more

San Diego Real Estate Blog July Traffic

San Diego Real Estate Blog July Traffic

Last month this San Diego real estate blog had over 29,800 unique visitors!

For the past six months, this San Diego real estate blog averaged over 29,600 unique visitors per month!

For the past six months, this San Diego real estate blog averaged over 29,600 unique visitors per month!

Thanks to all our loyal readers & site visitors.

California real estate agents, would you like to generate this type of Internet visitors for your site? Free info: E-mail seo711@gmail.com today.

San Diego Real Estate Blog

San Diego Real Estate – 5th Largest Decline Through July

San Diego California home values showed the 5th largest decline for the latest July 2007 to July 2008 S&P/Case-Shiller Home Price Indices.

“There are signs of a slow down in the rate of decline across the metro areas, but no evidence of abottom” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “Little positivenews can be found when cities like Las Vegas and Phoenix report annual declines as large as -29.9% and

-29.3%, respectively, and all 20 cities are still in negative territory on a year-over-year basis. The Sunbelt

continues to be the story, with the seven cities that basically represent that area reporting annual declines

roughly between 20 and 30%. While some cities did show some marginal improvement over last month’s

data, there is still very little evidence of any particular region experiencing an absolute turnaround.”

The table below summarizes the results for July 2008. The S&P/Case-Shiller Home Price Indices are revised for the 24 prior months, based on the receipt of additional source data.

San Diego Real Estate … The Coming Next Wave of Foreclosures

The first wave of foreclosures occurred due to the re-setting of some "sub-prime" loans. These loans were predominantly the 80/20 loans that were used to assist buyers to obtain property with no down payment. Later in the cycle of the origination of these loans, the documentation requirements were lessened considerably, so that by 2005, buyers were able to obtain 80/20 loans to purchase property with little- to no-income documentation. Buyers speculated on properties increasing in value and had little regard for the payments. As the loans re-set (usually 2-3 years later), the buyers found themselves unable to make the payments or unable to refinance, and the properties ended up in foreclosure.

The first wave of foreclosures occurred due to the re-setting of some "sub-prime" loans. These loans were predominantly the 80/20 loans that were used to assist buyers to obtain property with no down payment. Later in the cycle of the origination of these loans, the documentation requirements were lessened considerably, so that by 2005, buyers were able to obtain 80/20 loans to purchase property with little- to no-income documentation. Buyers speculated on properties increasing in value and had little regard for the payments. As the loans re-set (usually 2-3 years later), the buyers found themselves unable to make the payments or unable to refinance, and the properties ended up in foreclosure.

Here's what we need to understand about these loans:

1. Is that they were spread across the United States (demographic and geographic distribution) and

2. There were a lot of them done for buyers buying new homes. In San Diego, we are seeing the results of these loans as properties in newly constructed developments (Eastlake, San Marcos, Condo conversions, etc.) are defaulting in high numbers. However, the buyers of these properties generally DID understand that the loan would convert or "adjust" after an initial 2-3 (in some cases 5) year period. Further research suggests, however, that these buyers were not necessarily defaulting due to rising payments (the Fed has reduced short term rates significantly, thereby reducing the impact of the adjustment) but rather were defaulting to rid themselves of a negative equity position.

Many buyers in San Diego County who purchased properties in the $500k range and borrowed the entire $500k, and now find the property worth a current estimate of $400k are choosing to walk away from the negative equity position, regardless of ability to handle the payments. Research by the Federal Reserve has deemed these "unpreventable" foreclosures in that the property cannot be refinanced and the borrower is not compelled to keep the property with no hope of any short term appreciation.

However, the impact of these resets is nothing compared to the upcoming impact of the "option ARMs" that are going to reset in 2009 – 2011 (peaking in 2010).

During the housing heyday, borrowers quit even asking about rate, and asked instead "what are the lowest payments you can get me for this home." Lenders responded by offering the option arms with a 1% (or other similarly low) start rates but with a "real" rate tied to the LIBOR or to US Treasuries or other indexes. The use of these loans peaked in 2005. These loans were predominantly used in Southern California and other high cost housing areas and were used with a much greater frequency than in more "affordable" areas in middle America (not near the geographic diversity as the sub prime loans). Here's where it gets tricky. While folks with the 2/28 loans knew an adjustment was coming, many option arm borrowers are NOT aware that an adjustment is coming. Almost ALL option arms are structured in a similar fashion. They have a feature where they "re-cast" every 5 years. This means that at the end of the initial 5 year period, the initial start rate (often called the "teaser" rate) goes away. The loan will then reset or re-cast and the payments will be based on a full amortizing loan amount for the remaining 25 years of the loan. Many of the people with this type of loan simply do not know or understand that this will happen.

Here's an example. Let's say that a buyer purchased a property in 2005 for $550,000. If they put 10% down, they would have a loan amount of $495,000. With an initial "teaser" rate of 1%, they would have minimum payments for the 1st year of $1592 per month. If the "fully amortized" or "real" payment was based at say, 6.5%, the loan balance would go up by over $1500 per month. So, where would the buyer be at the end of the first year? Assuming that the buyer made only the minimum payment (which most do), the minimum payment can only increase by 7.5% of the PAYMENT AMOUNT. So, the $1592 payment become a $1711 payment. However, the buyer owed an additional $18,000 more than the $495,000 because of the negative amortization. What happens next?

In the 5th year, the minimum payment will be just over $2100 per month. Assuming that the "real" rate is in the 6.5% range over the initial 5 yrs (which looks pretty realistic based on current rates), the loan balance would have increased to approximately $550,000. What happens now?

This is the interesting part because even many savvy and educated buyers and borrowers simply do not know. What happens is this: The loan at that point "re-casts" and becomes amortized over the remaining 25 years at the current rate. If we continue to use the 6.5% as a reference point, the payment will go from $2100 to over $3700 a month!! Thats right, a $1500 per month increase ($550,000 at 6.5% for $25 yrs yields a pmt of $3713).

Meanwhile, the median value of a home that was worth $550,000 in 2005 might only be $400,000 in 2010 (assuming a decline of 25% in value. Per today's San Diego Union Tribune, the value of the average SD home lost 25% in the last year alone, so the $400k estimated value figure might be generous). Now, imagine how many people with a $400,000 property and a $550,000 loan are going to hang in there after finding out that their payment is going up $1500 per month?

This will be the next wave of foreclosures. These loans and properties are in all areas of San Diego, not just the newly constructed properties on the outskirts of town. The fallout of these foreclosures in San Diego will hit higher end and coastal areas and everywhere in between. YIKES! Many thanks to our guest author, Mr.Greg Brooks Southwest area manager San Diego Mortgage Network for this enlightening post. *Ed notes: The next bank with possible trouble??… I've been told Downey Savings & Loan was a major player in the option arm business and about a year ago their non-performing loans were at appx. 1.3%. In June 2008, it's said that Downey's non-performing loans are now appx. 15%! San Diego real estate blog

Real Estate – Jim Rogers says Fannie and Freddie are a ‘disaster’

"The U.S. Treasury Department's plan to shore up Fannie Mae and Freddie Mac is an “unmitigated disaster'' and the largest U.S. mortgage lenders are “basically insolvent,'' according to investor Jim Rogers.

Jim Rodgers, is the chairman of Rogers Holdings, in April 2006 he correctly predicted oil would reach $100 a barrel and gold $1,000 an ounce, also said the commodities bull market has a “long way to go''. Rogers, a former partner of hedge fund manager George Soros, predicted the start of the commodities rally in 1999. San Diego real estate agents

San Diego BE WISE: WATER WISE

Sprinklers, hoses, pools – there are many ways to use water outdoors in the summertime. There are also countless and easy ways to conserve it. Following are a few tips for developing good H2O habits:

Sprinklers, hoses, pools – there are many ways to use water outdoors in the summertime. There are also countless and easy ways to conserve it. Following are a few tips for developing good H2O habits:

Water your lawn only when necessary. Walk across the lawn; if you leave footprints it is time to water (usually once every three days).

To minimize evaporation, water your lawn during the early morning hours, when temperatures are cooler and winds are lighter.

Divide you watering cycle into shorter periods to reduce run-off and allow for better absorption.

Periodically check your pool for leaks if you have an automatic refilling device.

Weed your lawn and garden regularly; weeds compete with other plants for nutrients, light and water.

When the kids want to play in the water, use the sprinkler in an area where your lawn needs it most.

Use sprinklers that throw big drops of water close to the ground.

Use a hose nozzle and turn off the water while you wash your car – you’ll save more than 100 gallons.

Use a screwdriver as a probe to test soil moisture; if it goes in easily, don’t water.

Use a grease pencil to mark the water level of your pool, and check the mark 24 hours later. Your pool should loose no more than ¼ inch each day.

Check your sprinkler system frequently and adjust sprinklers so that only the lawn (not the house, sidewalk or street) is watered. San Diego real estate blog