California housing crisis

California housing crisis 2017

My personal view and opinion on the crisis in California housing.

Personally, just to keep things pretty simple it’s a well-known fact that here in San Diego County, a huge percentage of the new homes building cost (I believe in the 40% range) is comprised of city and state building and construction fees. So, why do we need a special councils always investigating our problem when it’s quite obvious that our own city and state have created most of these problems by their onerous imposition of government fees. Read more

San Diego Housing Traffic

San Diego Housing Traffic

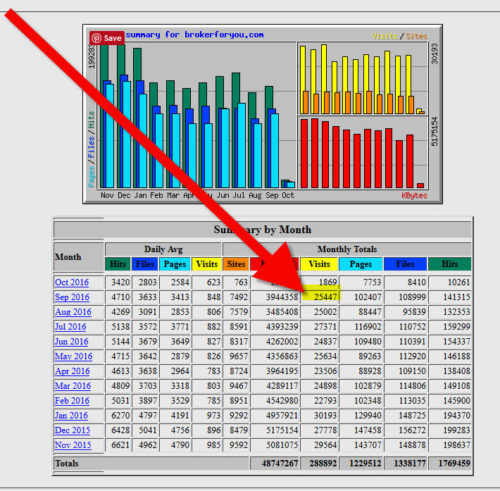

The chart below shows the unique traffic to www.brokerforyou.com for September 2016.

Yes, in September brokerforyou.com generated over 25,400 unique visitors!

Many times various website owners quote traffic by saying how many hits their website generated in a month. if you look to the right column on this chart it does show the monthly hits and for September that was over 141,300. But, the reason I don’t quote that is because many hits could be generated by just one visitor. I’m not going to get into how hits are calculated here, except to say that anyone who is promoting their site by saying how many hits it receives is really being misleading or very naïve.

The best way, to determine real visitors is by unique visitors, where one unique IP address is counted in a 24-hour period. Read more

San Diego Real Estate – A Bottom … Not A Reversal

When the San Diego real estate market hits bottom, it will be just that, a bottom, not a reversal. Don’t believe that home prices will spike up and shoot back up to pre-bust levels any time soon! I find that highly doubtful even if the economy were healthy in other sectors because who is going to fuel this reversal? Will it be the people who have foreclosures and short sales on their credit history, or another group of salivating sub-prime buyers?

When the San Diego real estate market hits bottom, it will be just that, a bottom, not a reversal. Don’t believe that home prices will spike up and shoot back up to pre-bust levels any time soon! I find that highly doubtful even if the economy were healthy in other sectors because who is going to fuel this reversal? Will it be the people who have foreclosures and short sales on their credit history, or another group of salivating sub-prime buyers?

Credit is tightening up to the point that home buying is truly back to where you actually have to put 5 to 20% down and have a decent credit rating. That will restrict the pool of available buyers considerably, which will prevent another ridiculous up-ride on the home price roller coaster.

The “bottom” will be the new median home price, according to what the local marketplace and income levels dictate, with modest year to year appreciation.

Until the ‘real’ bottom is reached in the San Diego real estate market, expect many false upward spikes driven by people looking at only one set of data and incorrectly timing the best time to buy.

Related prior posts:

#1 Key To Purchasing Real Estate in the San Diego Market

San Diego California Home Sellers Lose Big

The San Diego California Real Estate Great Depression

Believe the local San Diego ‘experts’ that subprime delinquencies are slowing?

San Diego County Foreclosures up 125% from 2007

Jumbo Financing and the Impact on The San Diego Real Estate Market

Another Look at the June Rise in Pending Home Sales

San Diego Housing Problem is Getting Worse

The number of delinquencies is a dynamic that obviously changes relative to the environment. I apologize for not providing some insight into the hard numbers that your above post requests. Where are we in this process and how much of the problem has already been written off? Is it getting worse, better, or going to be the same and for how long? Read more

San Diego Home Prices

In yesterday’s San Diego Union Tribune the main story in the business section was titled “County and state home prices facing a ‘double dip’ They’re up from last year, but heading downward, Zillow and Realtors report“. I give credit to the Union for reporting the facts, but to toot my own horn, here is part of what I said back in this blog on 5-1-10, in a post titled San Diego California Home Prices … Worst is Over : “I believe the government tax credits (which may be mostly speeding up sales that would have occurred normally) and the fact that a huge number of loans were due to have their first adjustment this year, could cause a double dip in San Diego housing values.”

My point is that if you want a good indication about the current and future San Diego California home prices, you would be wise to get a free subscription to this blog.

Here are some facts from the most recent Seattle-based Zillow company report:

- San Diego and four other California markets were the only ones nationally that posted price declines in the third quarter after five quarters of increase.

- Zillow figures San Diego values are now 31.1 percent off their peak of $538,100 set in September 2005.

- Zillow’s figures for San Diego in the third quarter showed an overall home value of $370,600, up 4.2 percent year over year but a 0.7 percent decline from the second to the third quarter and 0.3 percent decline from August to September.

- Nationally, home values declined 4.3 percent year over year and 1.2 percent quarter over quarter. They have declined for 17 consecutive quarters and are down 25 percent their peak.

- 23.2 percent of single-family homeowners nationally owe more than their homes are worth.

San Diego California Housing Double Dip

In my 7-7-10 my post:  San Diego real estate 2010 2nd. Half Outlook … double-dips I said that my local San Diego real estate market observations indicated that we are heading into a double dip for the real estate market.

Here is what Forbes just said: “The final figures for the U.S. housing market’s performance thus far in 2010 won’t be officially released for several weeks. But a review of the best preliminary data available indicates that the recovery in home values that began in early 2009 has stalled. A second dip is clearly under way in some places, if not across the entire U.S.†Read more